Why Choose Tax Cutter?

Tax Cutter helps property owners by providing the best property tax reduction services that ensure the best savings. Meanwhile, you just sit back and relax.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Tired Of Paying High Property Taxes?

Millions of Texans overpay property taxes due to inflated assessments. Protesting is your right, but the process can be challenging without expert support in property tax reduction.

Say Goodbye To Overpaying Property Taxes

Tax Cutter aggressively protests to lower your property value at your local county appraisal district on your behalf. We tailor the property protest case specifically to your property for the maximum property tax reduction.

How Tax Cutter Works?

Your county aims to maximize tax revenue by inflating your property value. Our expert property tax professionals build your protest case by utilizing their years of experience along with proprietary data-driven technology to get you the maximum savings on your property taxes.

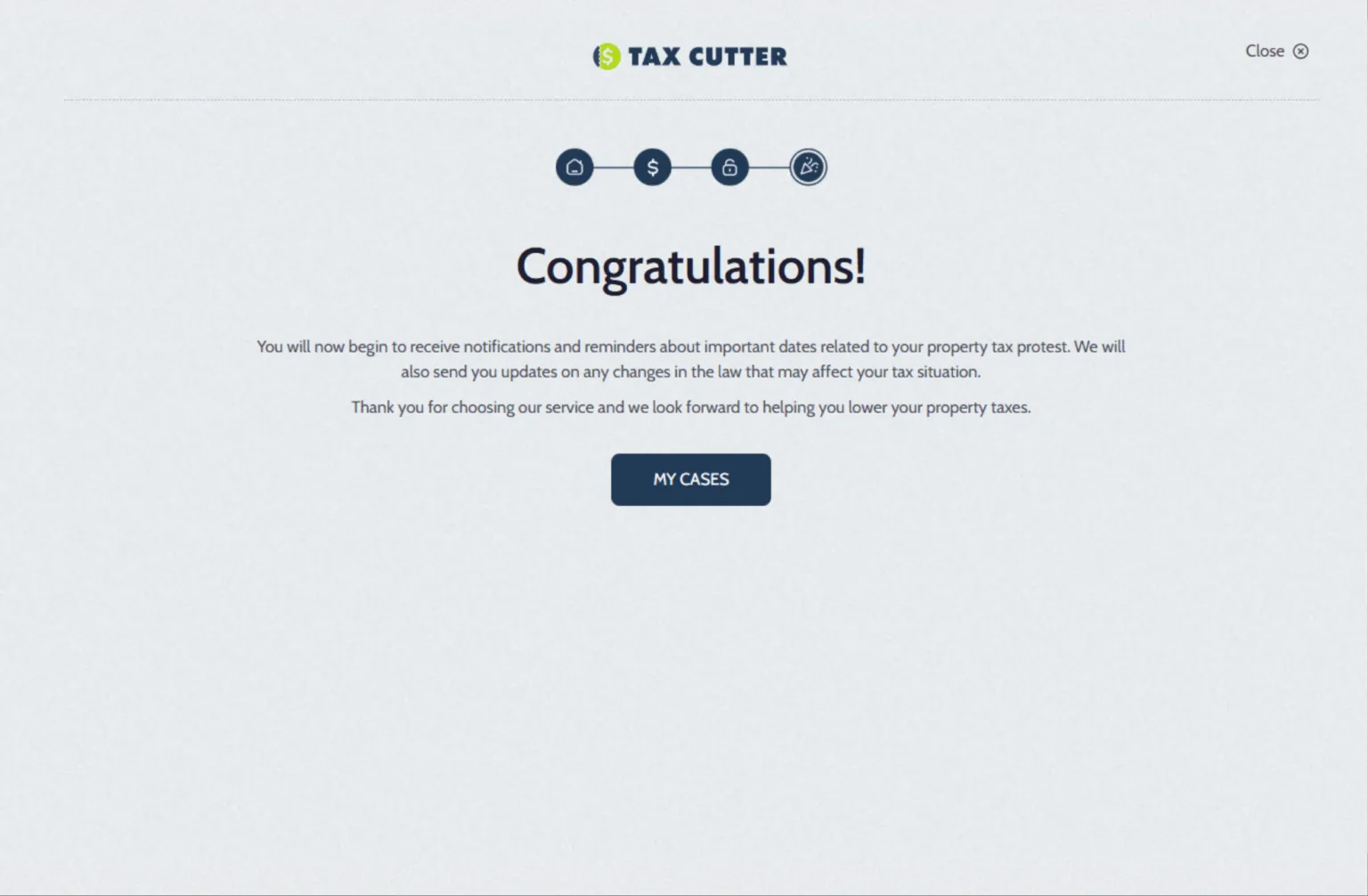

We Manage The Protest, You Get The Savings!

Tax Cutter handles your Texas tax protest from start to finish, including informal protests and representation before ARB. We keep you in the loop on your protest updates while we get you the best savings.

Risk-Free Sign Up, Pay Only If You Save

Risk-free savings start here! With our Shared Savings Plan there is a zero cost to sign up and you only pay if we save you money. Your success is our success!

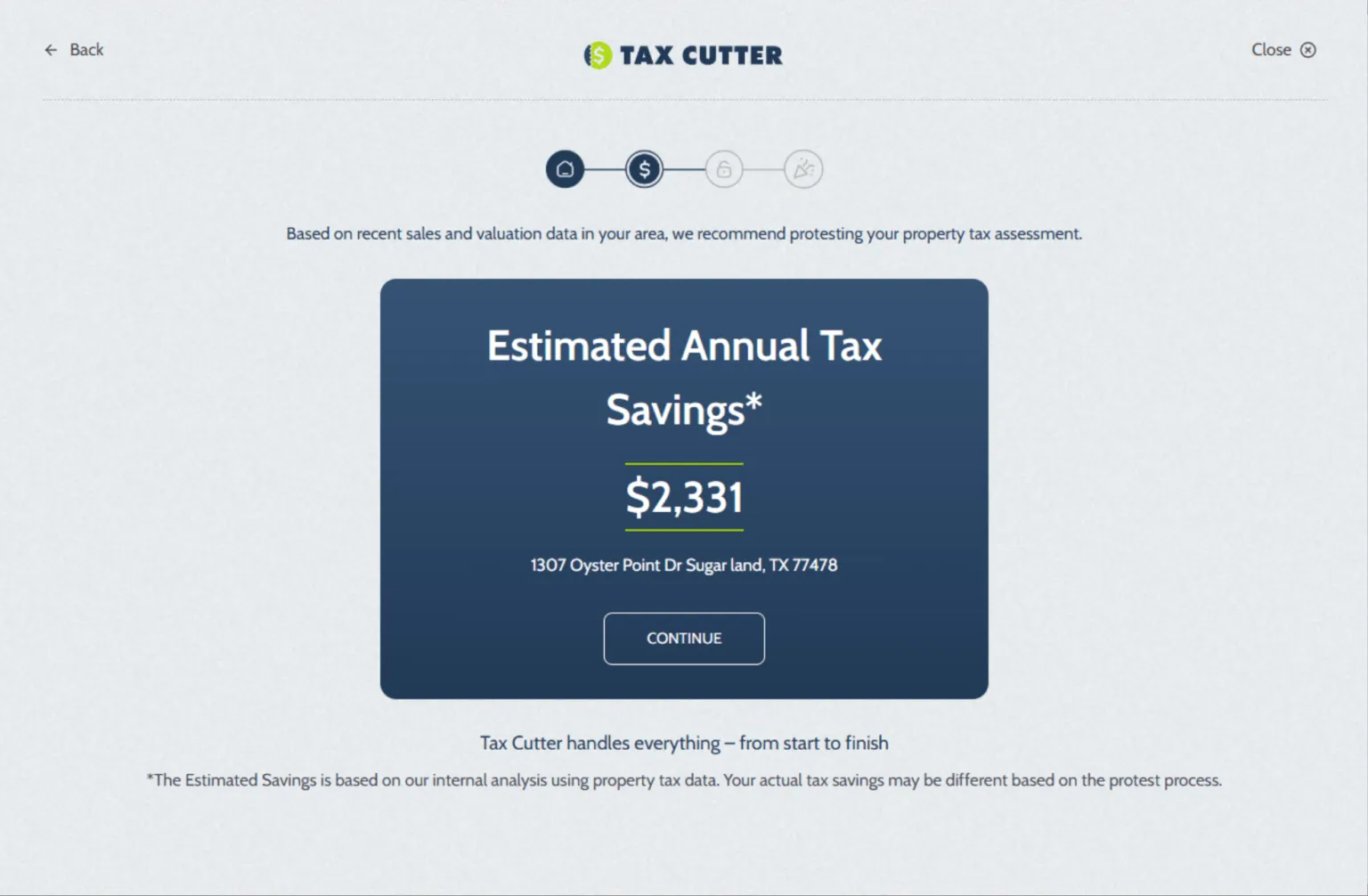

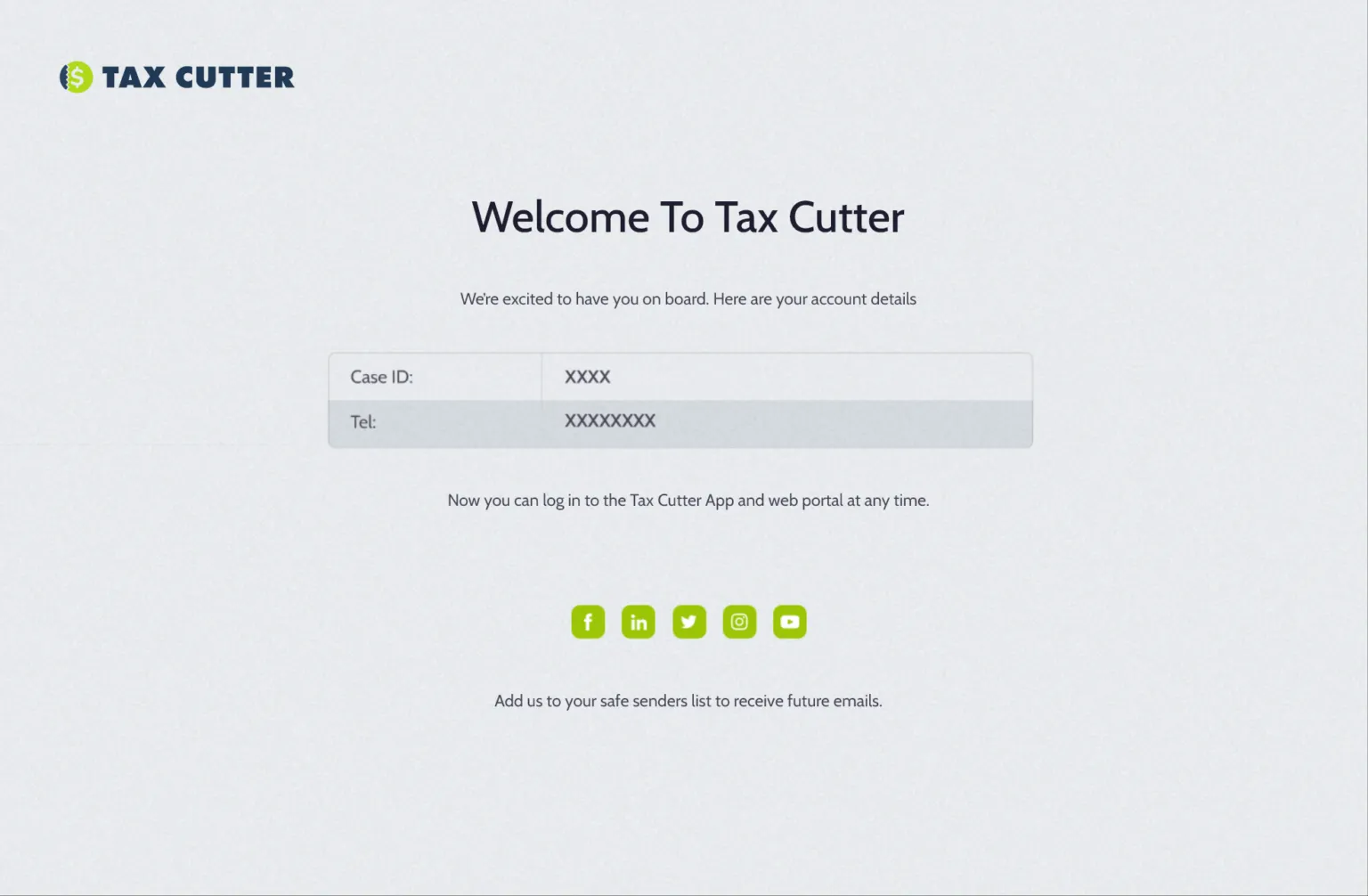

Quick & Easy Digital Sign Up

Sign-up made simpler than ever—fast, effortless, and hassle-free!

Steps to sign up

Serving All Counties Across The Great State Of Texas

We serve property owners in all 254 Texas counties, providing constant and reliable support for a seamless, stress-free Texas tax protest process.

Stories of Trust, Savings, and Success

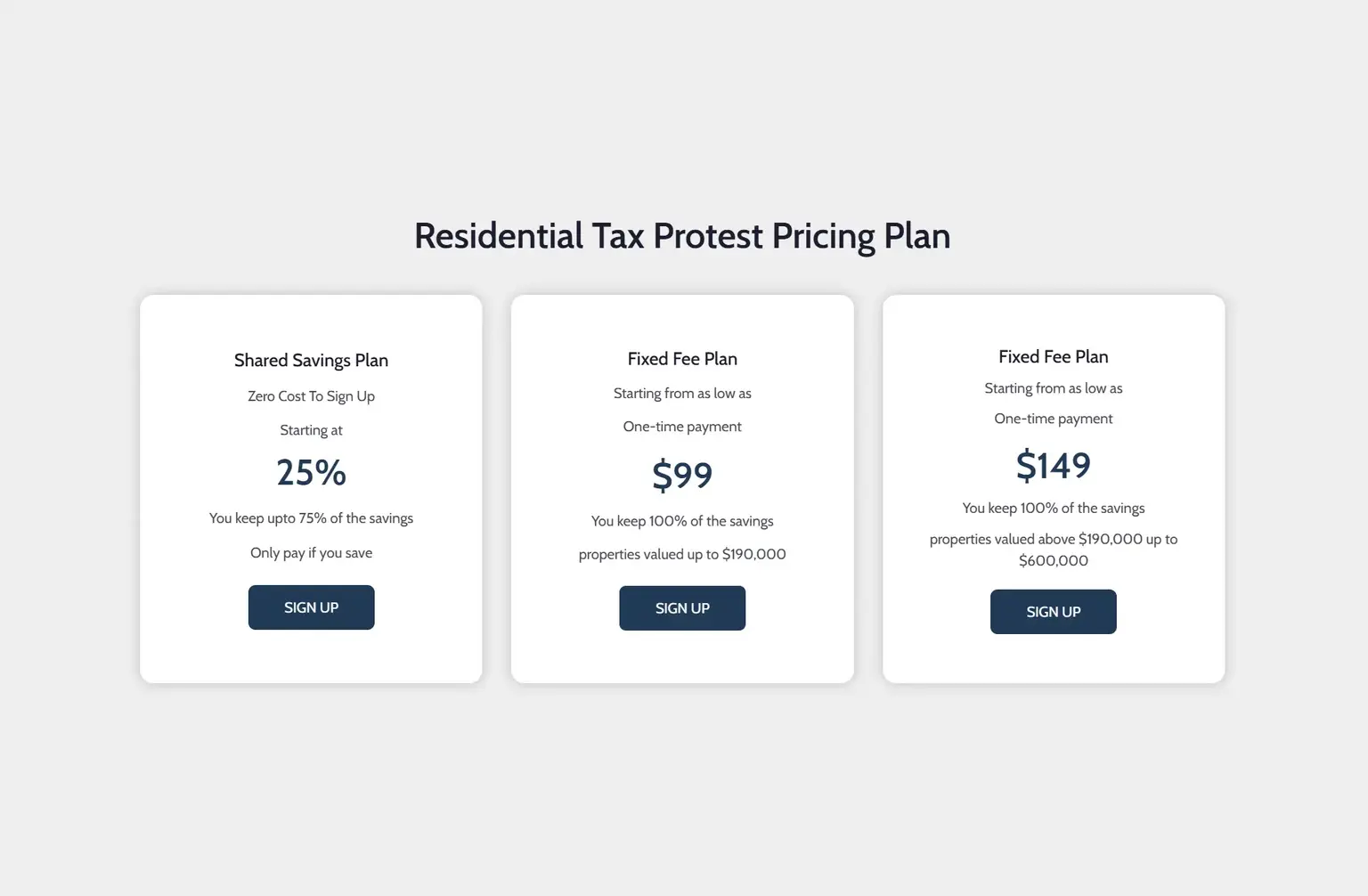

Residential Tax Protest Pricing Plan

Shared Savings Plan

Zero Cost To Sign Up

Starting at

25%

You keep upto 75% of the savings

Only pay if you save

Fixed Fee Plan

Starting from as low as

One-time payment

$99

You keep 100% of the savings

properties valued up to $190,000

Fixed Fee Plan

Starting from as low as

One-time payment

$149

You keep 100% of the savings

properties valued above $190,000 up to $600,000