Harris County Appraisal District HCAD Annual Budget

2024 Budget Insights: Key Changes and Trends

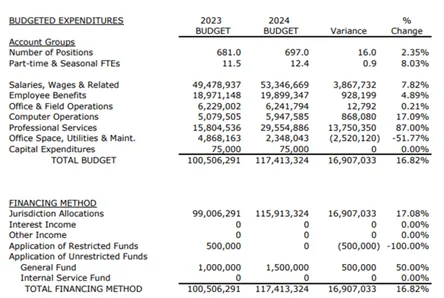

The 2024 HCAD budget saw significant shifts in allocations, with notable increases in some areas and decreases in others.

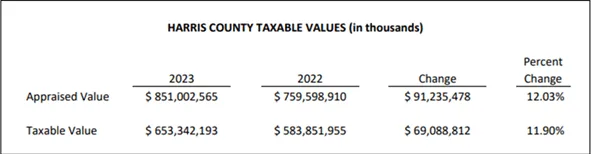

Harris County Property Values Overview

HCAD experienced significant increases in appraised and taxable property values from 2022 to 2023, boosting tax revenue. This revenue is added to the budget, supporting improved services and appraisal processes.

Bid Farewell To High Property Taxes

Tax Cutter helps maximize your savings with professional property tax analysts who aggressively protest on your behalf to Harris County central appraisal district. Sign up today for expert support with Texas tax protest, and let us handle the process.