Property Tax Protest Summary of Bexar County Bexar CAD

Summary of Property Tax Protests with Bexar County Bexar CAD

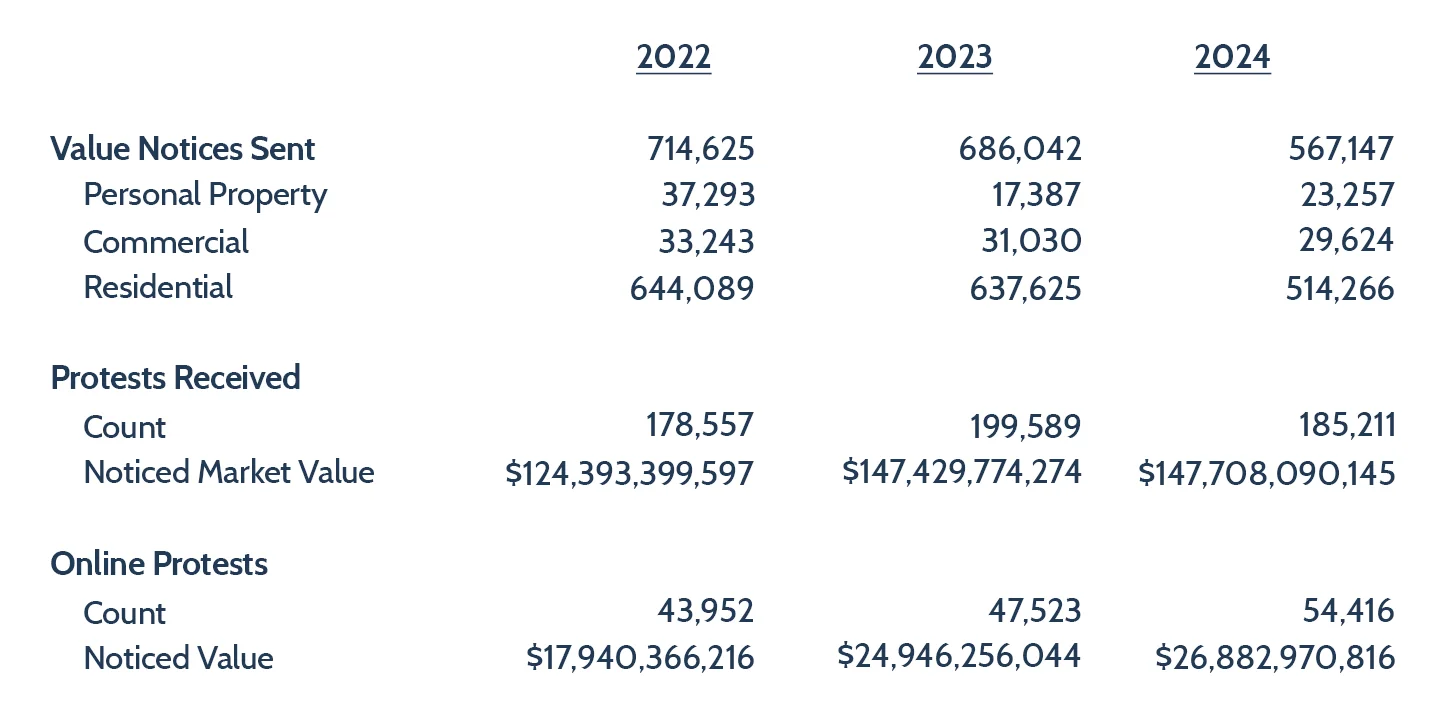

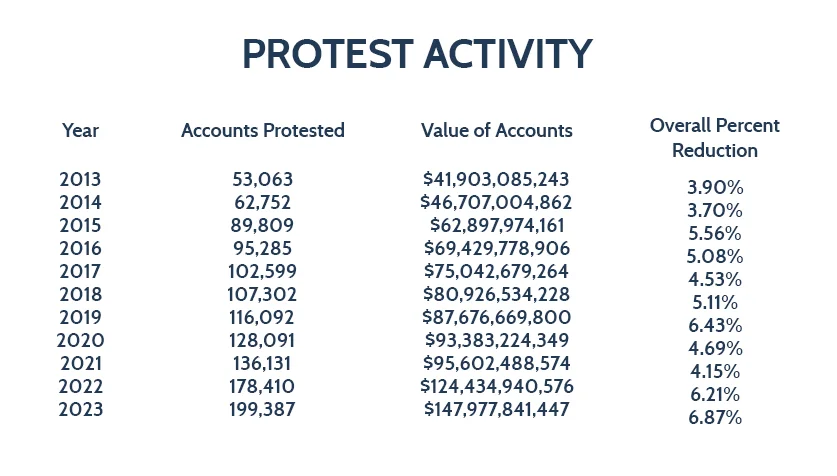

Property tax protests in Bexar County, managed by the Bexar County Bexar CAD, provide property owners an opportunity to contest their appraised property values. Property owners can file protests if they believe their appraised values are inaccurate or unfairly assessed. Over recent years, there has been a significant increase in the number of protests filed, with many property owners seeking adjustments to their valuations. As a result, Bexar CAD has witnessed a growing demand for hearings, with more property owners presenting their cases to the Appraisal Review Board (ARB). Statistics show a noticeable rise in successful protests, where property values are reduced based on evidence presented. This trend reflects both heightened awareness among homeowners and an increasing willingness to challenge property valuations. The Bexar County Appraisal District continues to provide guidance and support for individuals navigating the protest process, ensuring fairness and accuracy in the assessment of property values.

Property Tax Protest Summary

Join Tax Cutter! No Upfront Cost, Only Pay When You Save

Take Control of Your Bexar County Apprisal District Property Taxes

Tax Cutter offers professional analysts who are dedicated to helping you secure maximum savings by handling your Bexar County property tax protest from start to finish. Let us take the stress out of the process while you focus on what matters most.