Montgomery County Property Tax Protest

Why Choose Tax Cutter?

Tax Cutter helps property owners by providing the best property tax protest services that ensure the best savings. Meanwhile, you just sit back and relax.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Is Your Montgomery CAD Property Assessment Accurate?

Many homeowners in Montgomery CAD face inflated property valuations, leading to unnecessarily high tax bills. The county aims to maximize tax revenue, often at the expense of property owners, while the Montgomery Central Appraisal District protest process can be confusing and overwhelming. If rising property taxes have left you frustrated and unsure how to challenge them, you’re not alone. The good news? You have the right to protest, and we’re here to help you fight for a fair and accurate tax assessment.

Lower Your Montgomery CAD Property Taxes Without the Stress

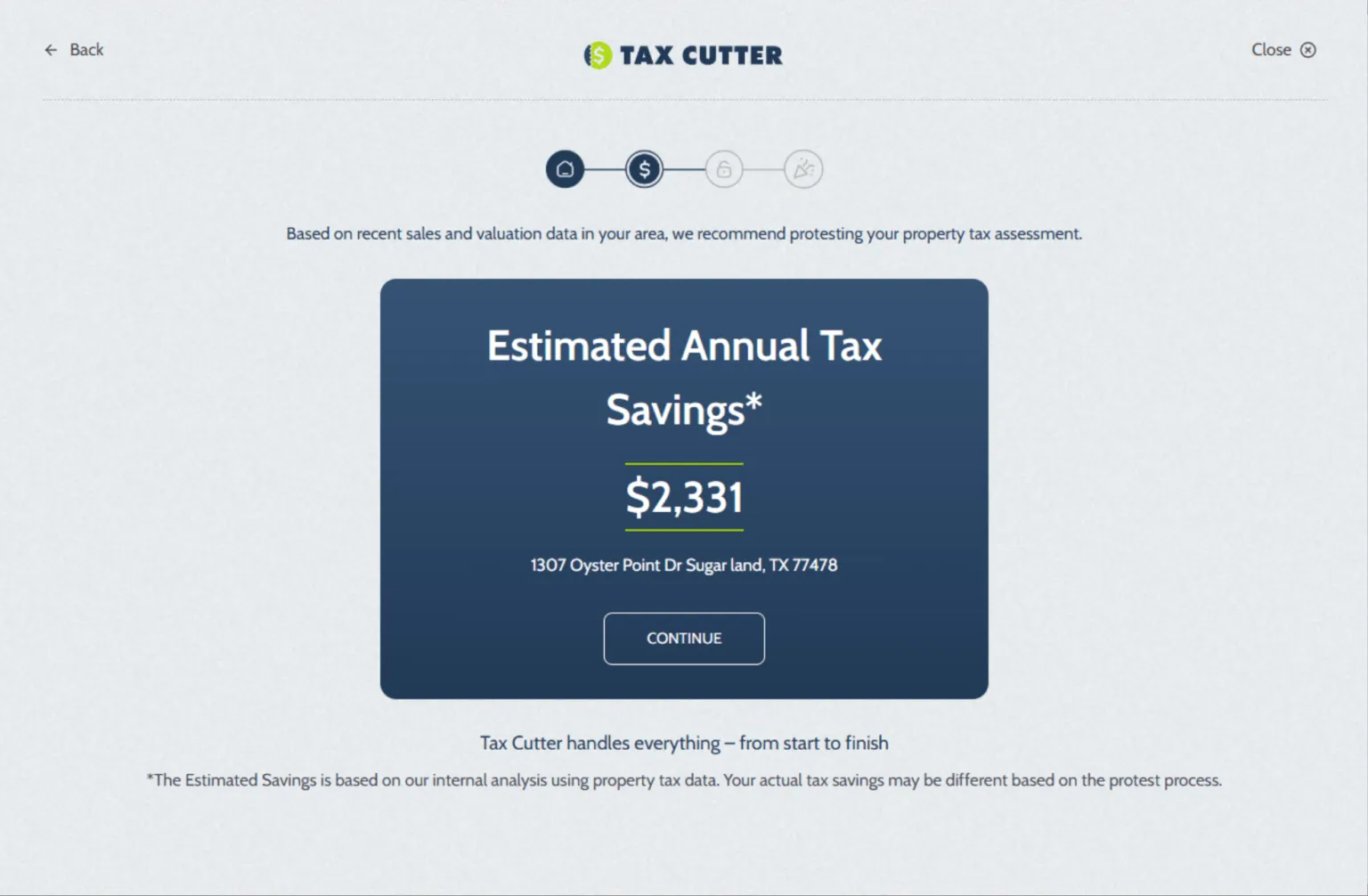

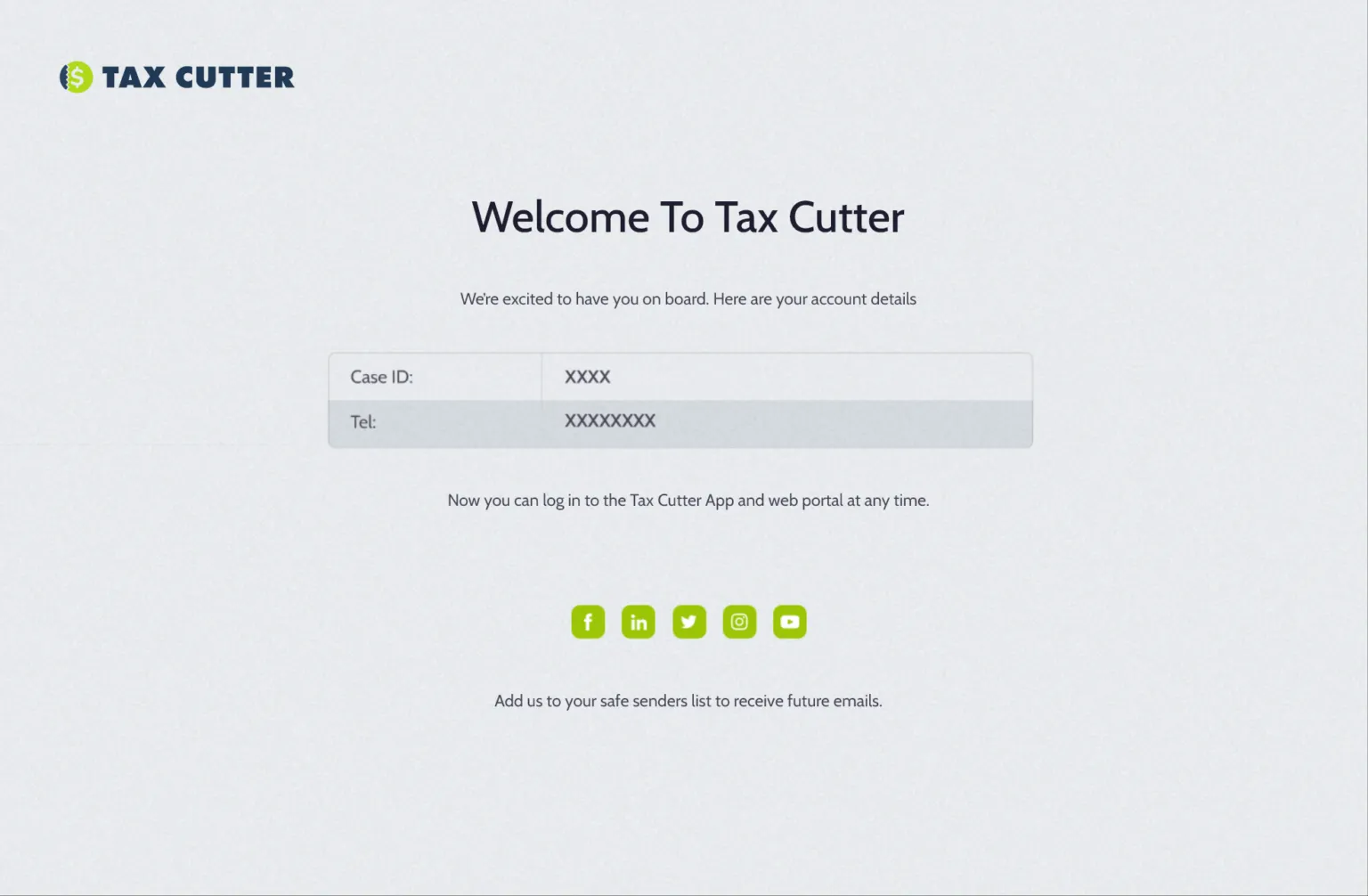

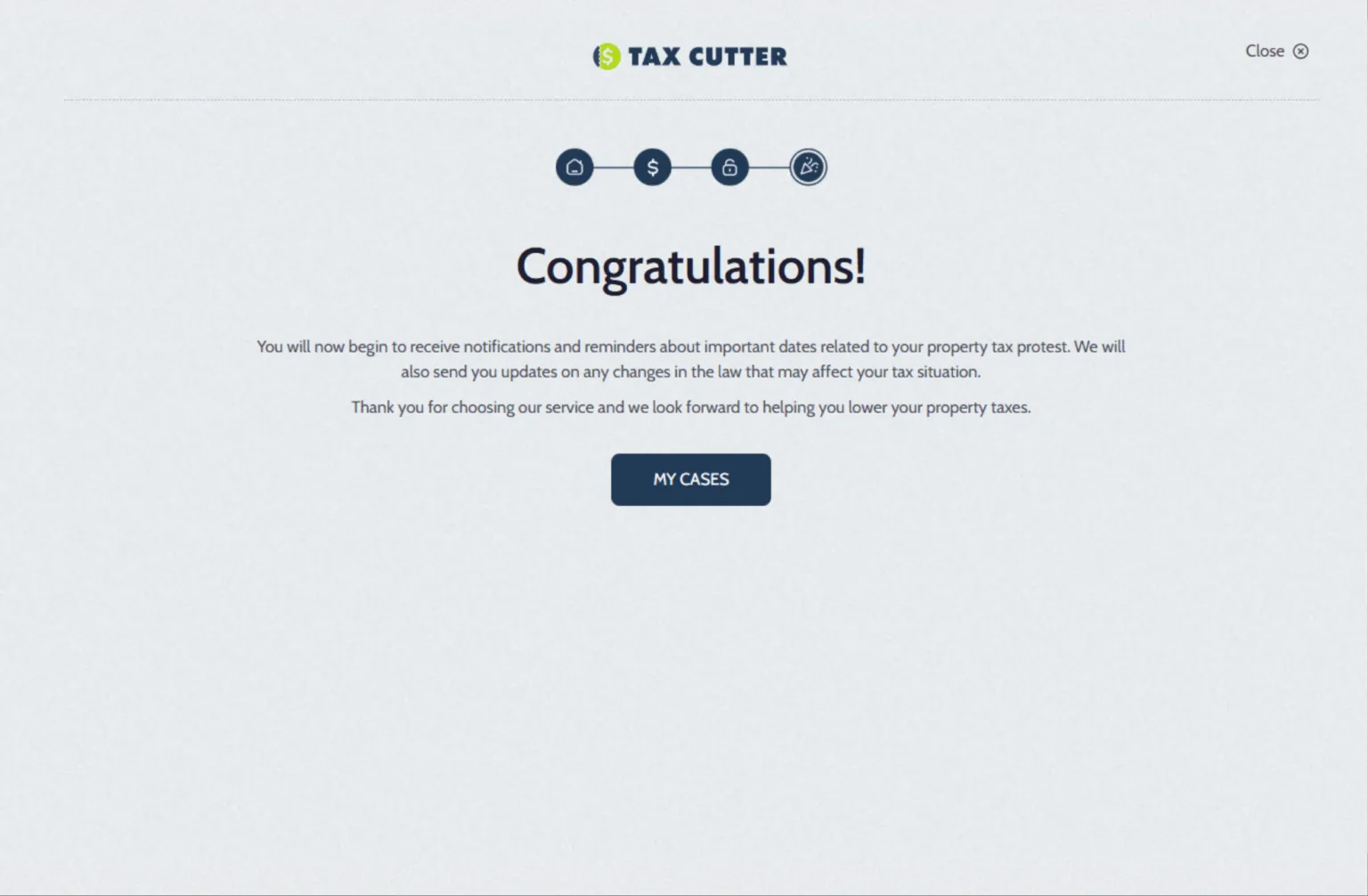

Overpaying on property taxes in Montgomery CAD? Tax Cutter makes it easy to fight back and lower your tax bill. Our tailored tax protest services ensure your home is fairly assessed, preventing overcharges without the hassle. Simply sign up, and our experts handle everything—from reviewing your appraisal to challenging unfair valuations. With a proven track record of saving homeowners thousands, we make reducing your property taxes simple and stress-free. Let’s get you the fair assessment you deserve!

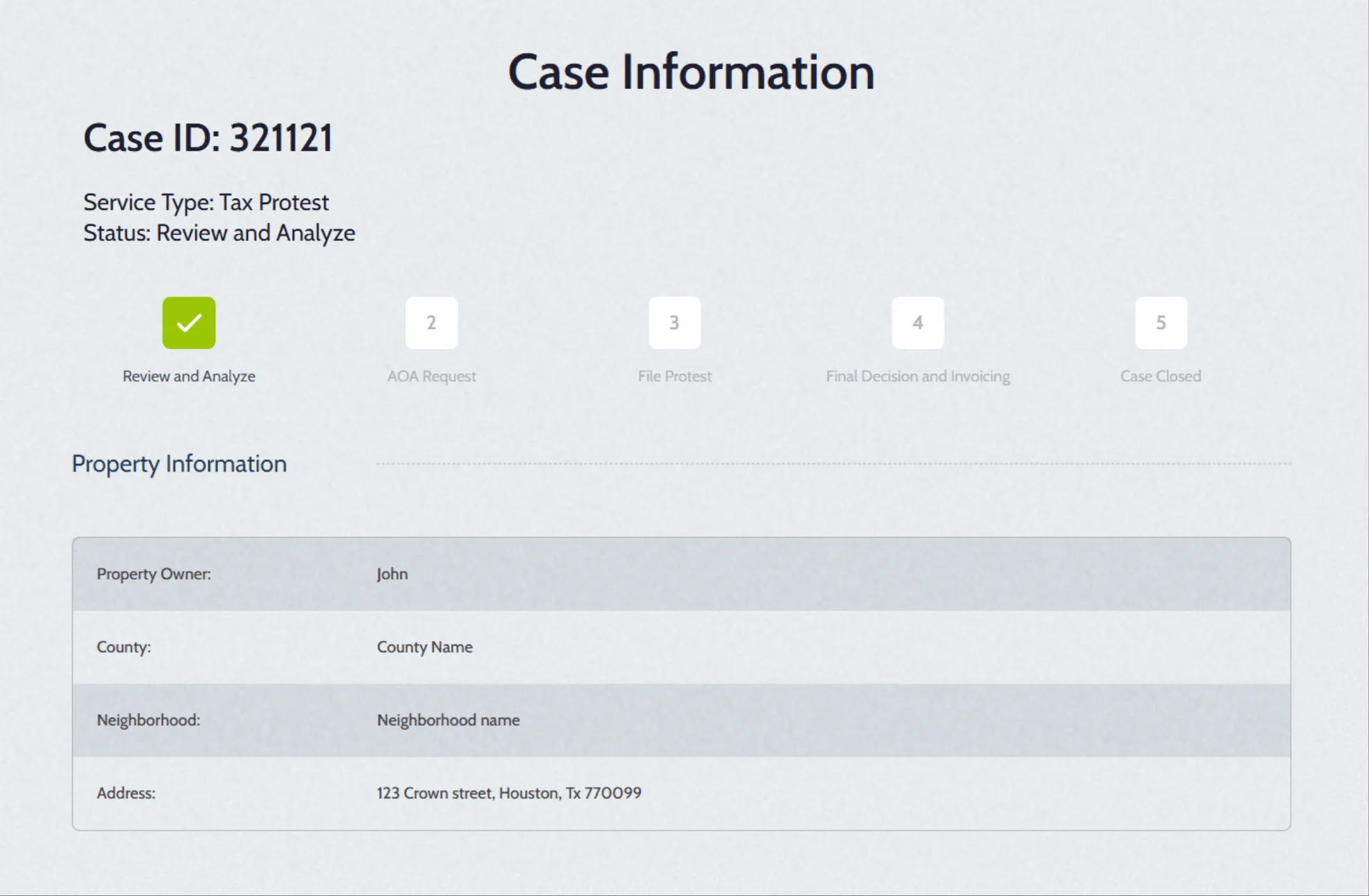

How Tax Cutter Works?

Our objective is to make the property tax protest process as easy and user-friendly as possible.

Benefits Of Choosing Montgomery CAD Tax Protest Services

We are dedicated to delivering superior tax protest services tailored for Montgomery CAD.

Don’t Overpay Taxes!

Thousands have saved hard-earned cash with our Montgomery tax protest. We fight unfair property appraisals to ensure you pay what’s truly owed, not a penny more. Let our experts handle the tax protest hassle and maximize your savings. Trust us, your savings await!

Accurate Valuations!

Worried your home is overvalued? Tax Cutter helps residential and commercial owners like you find the fair, accurate valuation your property deserves with our property tax protest service. Our smooth process takes care of everything, maximizing your property tax savings. Enjoy the peace of mind of knowing you’re paying what’s due – no more, no less.

Expert Property Analysis

Don’t get overcharged on your Texas property taxes! Tax Cutter helps you find the fair, accurate valuation your property deserves with a property tax appeal Montgomery We do the legwork, so you can relax. Forget tax code and confusing appraisals – our experts handle everything.

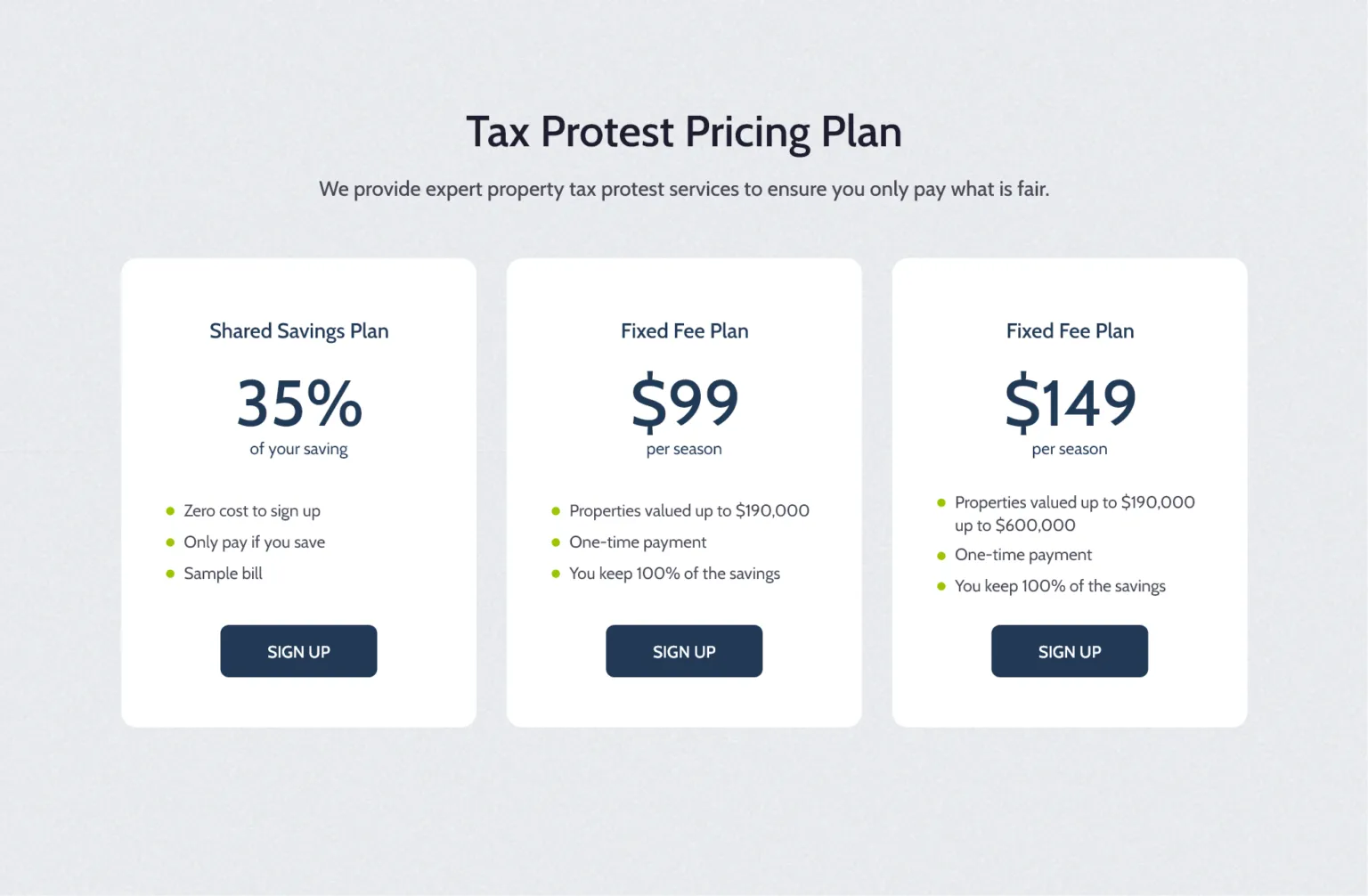

No Extra Payments

Relax! Tax Cutter doesn’t ask for a dime until you score savings on your tax bill. That’s right, no sign-up costs, no hidden fees – only pay when you win with our Montgomery protest property taxes. Trust us to fight for your fair share, knowing you have nothing to lose and everything to gain.

Experienced Suggestions

Our tax protest experts know how to find legal loopholes and uncover inaccuracies that could be dragging down your home’s worth. The result? More money in your pocket and a more valuable property. Win-win! Don’t settle for an unfair tax burden – TX tax protest Montgomery CAD with Tax Cutter.

Experts At Your Disposal

Your property protest is in good hands. At Tax Cutter, we’re dedicated to making the process simple and stress-free for you. From start to finish, you’ll experience exceptional customer service from our team of property tax experts. We’ll handle everything so you can focus on what matters most. Leave the hassle and worry to us – we’ll take care of the rest.

Your Guide to All Things Montgomery CAD: Navigate with Ease

Montgomery County’s Trusted Experts in Property Tax Savings

When it comes to lowering your property taxes, Tax Cutter is the trusted choice in Montgomery. Our team of property tax experts knows the Montgomery Central Appraisal District system inside and out. Using data-driven technology, we pinpoint overvaluations and build a solid case for your tax reduction. Our online tax protest platform makes the process effortless—just sign up, and we handle everything. From filing your protest to representing you at every step, we work to secure the maximum possible savings with zero hassle.