Budget for Montgomery County Appraisal Texas

Budget Insights in Montgomery CAD

The Montgomery County Appraisal Texas (MCAD) budget plays a key role in ensuring efficient property tax assessments and services for the county. Understanding this budget helps residents and property owners stay informed about how officials utilize tax dollars. The Montgomery County Tax Appraisal District allocates funds to maintain accurate property valuations and ensure transparent operations.

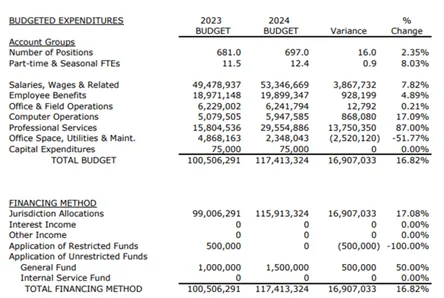

Montgomery CAD Budget Allocation

The Montgomery County Appraisal Texas budget is structured to support property valuations and ensure efficient administrative operations for taxpayers.

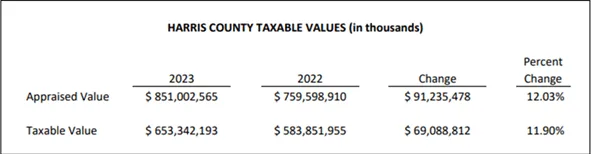

Taxpayer Impact & Financial Efficiency

The Montgomery County CAD aims to use its budget efficiently while conducting residential and commercial property assessments for all taxpayers.

Bid Farewell To High Property Taxes

Tax Cutter helps maximize your savings with professional property tax analysts who aggressively protest on your behalf to Montgomery County appraisal texas.

Sign up today for expert support with Texas tax protest and let us handle the process!