Fort Bend County Property Tax Protest

Why Choose Tax Cutter?

Tax Cutter helps property owners by providing the best property tax protest services that ensure the best savings. Meanwhile, you just sit back and relax.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Cut Your Property Taxes In Half With A Fort Bend Property Tax Protest

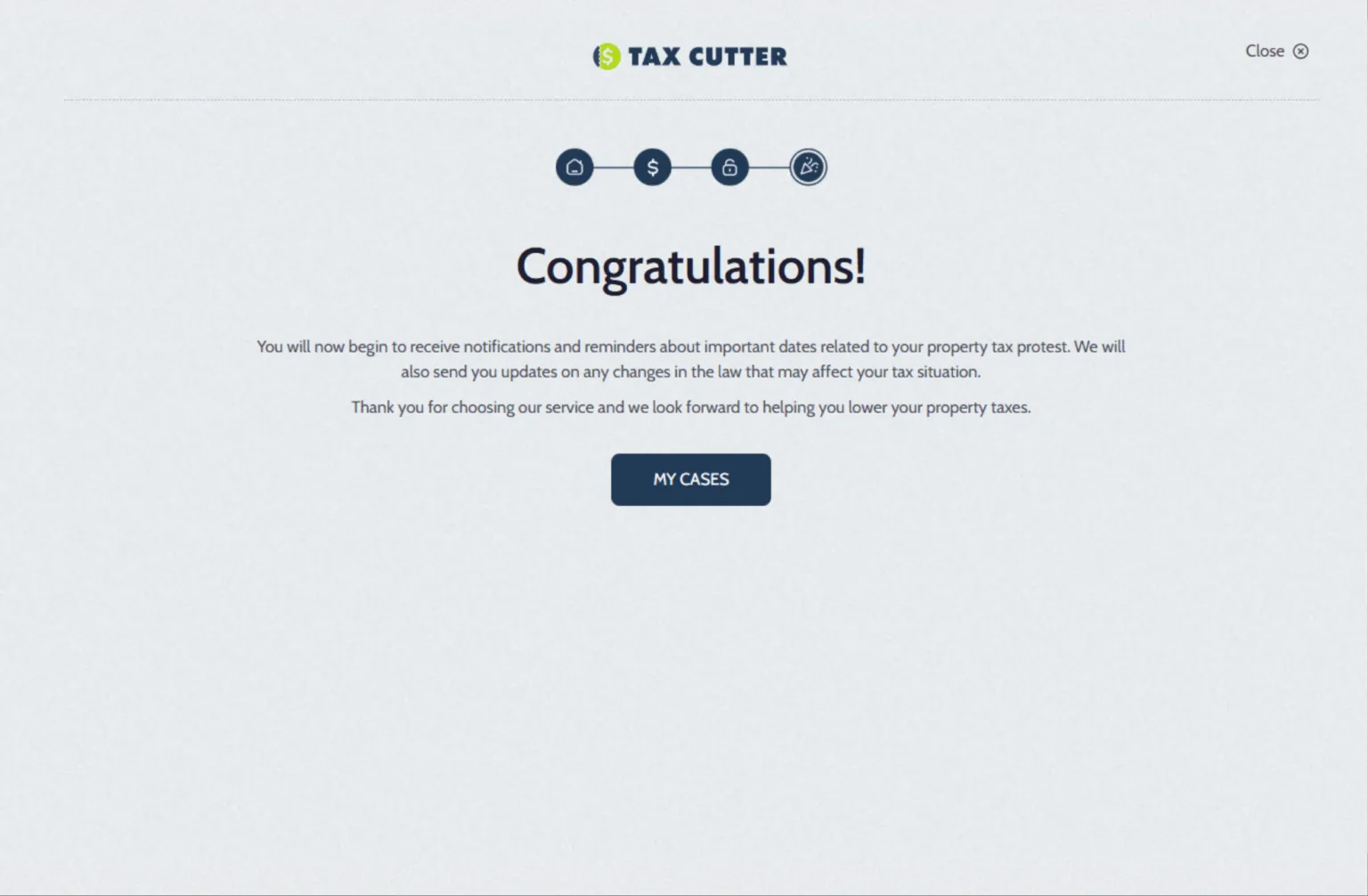

Tired of overpaying your property tax? Tax Cutter is the tax protest company you’re looking for! We’re expert tax protestors dedicated to reducing unfair valuations and saving you money. Do you think your home or property is assessed too high? We’ll look deeper, analyze your property, and fight for a fair and accurate valuation. Over the years, our tax appeal services have saved clients tens of thousands. Contact us today and join the fight for tax justice.

We’ll Help You With Your Property Tax Protest In Fort Bend County

Property taxes got you down? Feeling stuck with an unfair valuation? That’s where we step in with expert protest services. Skip the hassle of searching! We do the legwork, analyzing your property value against recent sales and doing intensive searches. If we see an overvaluation, we’ll protest for a fair price – that’s our promise. We aren’t just about saving you money. We believe in transparency, honesty, and fair play. We keep you informed every step of the way, and we never charge you a dime unless you win. Don’t settle for an unfair tax burden. Protest taxes with Tax Cutter – your trusted advocates for property tax justice.

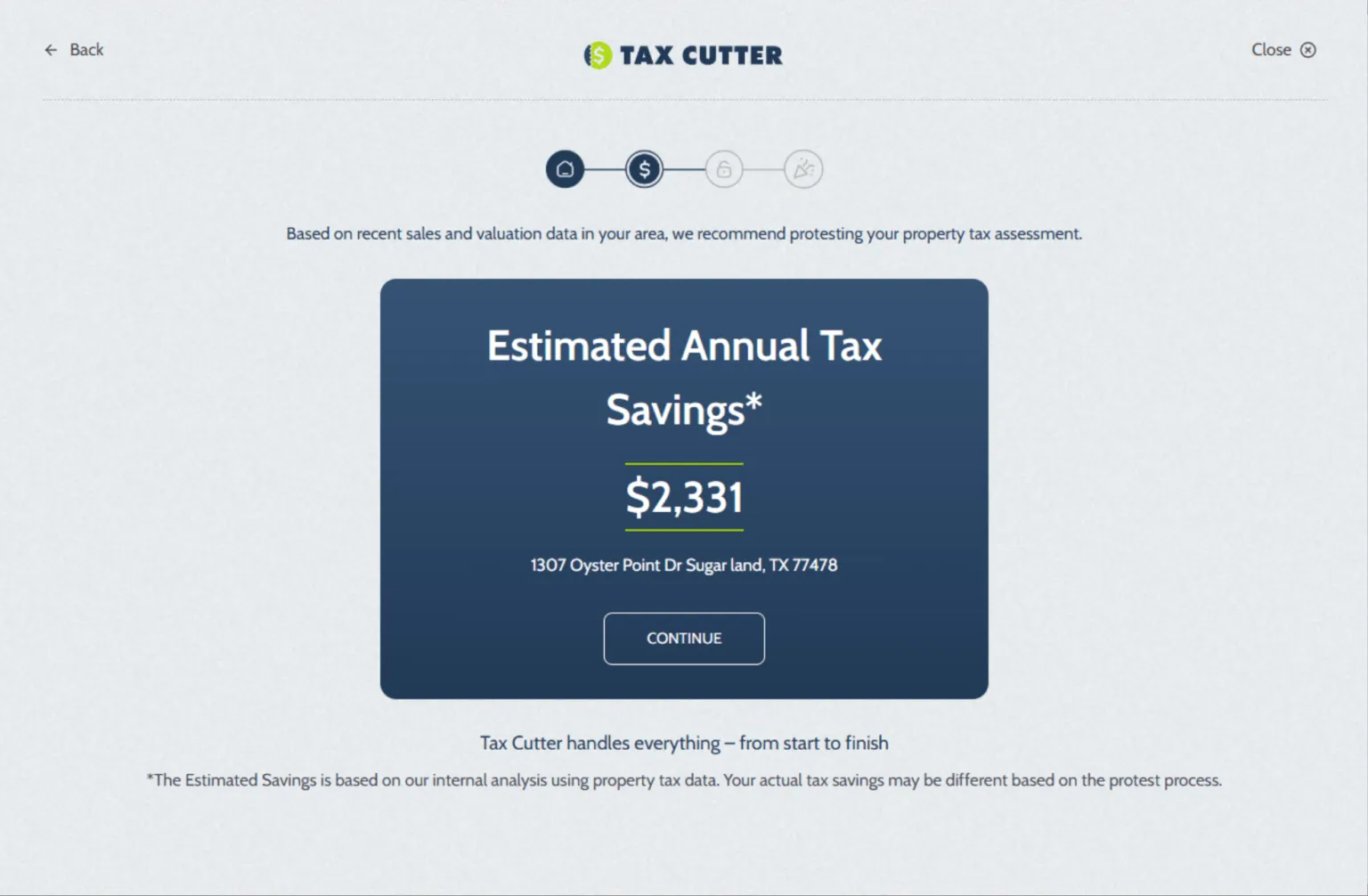

How Tax Cutter Works?

Our objective is to make the property tax protest process as easy and user-friendly as possible.

Benefits of Choosing FBCAD Tax Protest Service

We are dedicated to delivering superior Fort Bend County Property Tax Protest Services.

Don’t Overpay Taxes!

Thousands have saved hard-earned cash with our tax protest. We fight unfair property appraisals to ensure you pay what’s truly owed, not a penny more. Let our experts handle the tax protest hassle and maximize your savings. Trust us, your savings await!

Accurate Valuations!

Worried your home is overvalued? Tax Cutter helps residential and commercial owners like you find the fair, accurate valuation your property deserves with our property tax protest service. Our smooth process takes care of everything, maximizing your property tax savings. Enjoy the peace of mind of knowing you’re paying what’s due – no more, no less.

Expert Property Analysis

Don’t get overcharged on your Texas property taxes! Tax Cutter helps you find the fair, accurate valuation your property deserves with a property tax appeal. We do the legwork, so you can relax. Forget tax code and confusing appraisals – our experts handle everything.

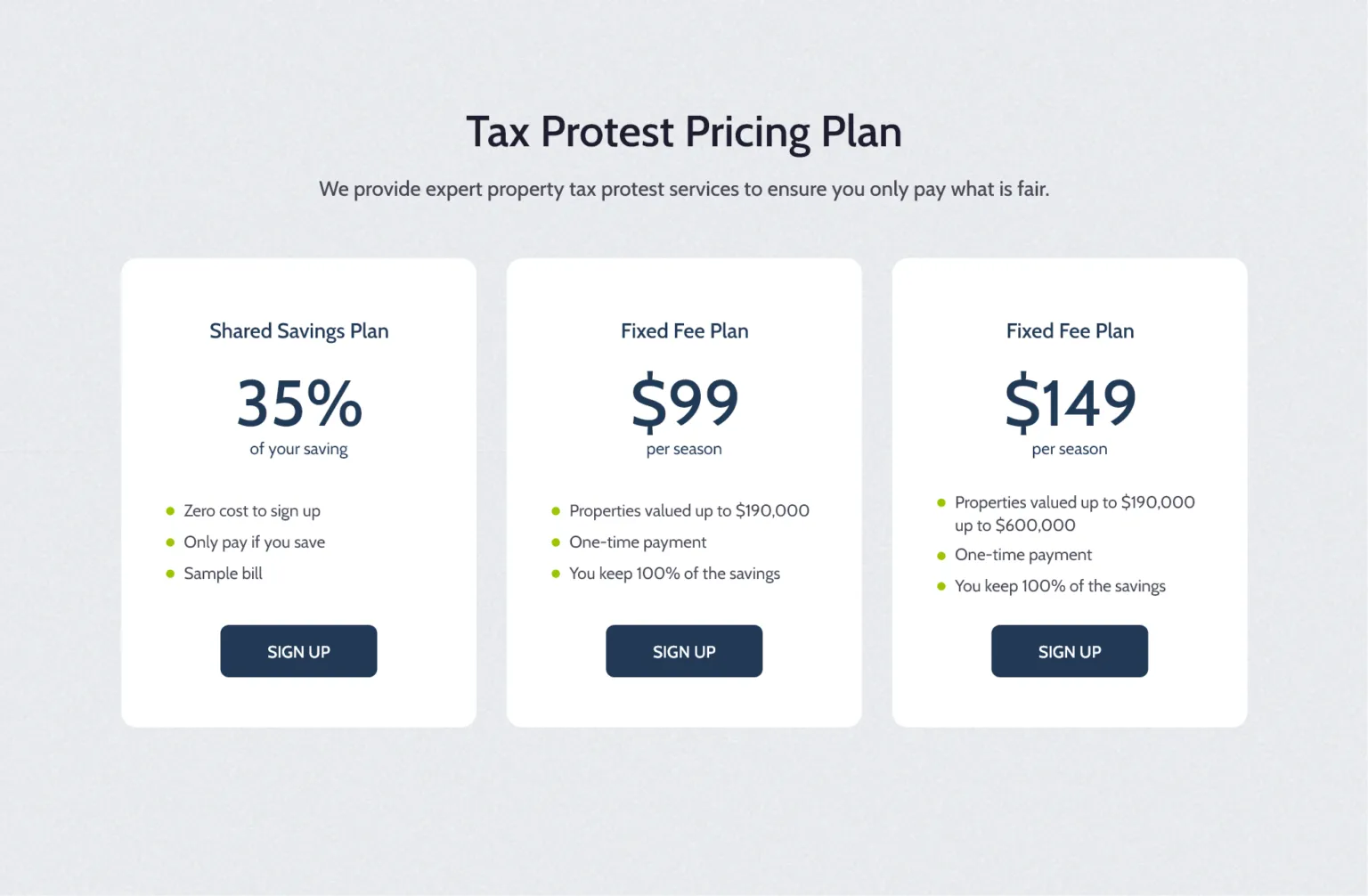

No Extra Payments

Relax! Tax Cutter doesn’t ask for a dime until you score savings on your tax bill. That’s right, no sign-up costs, no hidden fees – only pay when you win with our protest property taxes. Trust us to fight for your fair share, knowing you have nothing to lose and everything to gain.

Experienced Suggestions

Our tax protest experts know how to find legal loopholes and uncover inaccuracies that could be dragging down your home’s worth. The result? More money in your pocket and a more valuable property. Win-win! Don’t settle for an unfair tax burden – protest with Tax Cutter.

Experts At Your Disposal

Your property protest is in good hands. At Tax Cutter, we’re dedicated to making the process simple and stress-free for you. From start to finish, you’ll experience exceptional customer service from our team of property tax experts. We’ll handle everything so you can focus on what matters most. Leave the hassle and worry to us – we’ll take care of the rest.

Your Guide to All Things FBCAD: Navigate with Ease

Providing The Best Property Tax Protest Service In FBCAD

Navigating a property tax protest can be confusing, but that’s where Tax Cutter comes in. As local experts with a proven track record, we empower property owners to secure a fair tax assessment – with no upfront costs and transparent communication at every step. Our expertise allows us to identify overvaluations and build a strong case for a reduction. Don’t let fear or paperwork stop you from exercising your right to protest! We help review your appraisal, gather evidence, and guide you through the process, maximizing your chances of success. Remember, deadlines apply, so don’t delay. Choose the best property tax protest team as your trusted partner in this fight for tax justice.