Budget for Collin County Appraisal District

Collin County Central Appraisal Budget Overview

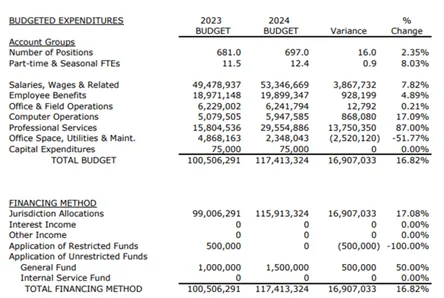

The Collin County Appraisal District budget is vital for ensuring accurate property appraisals, efficient operations, and fair taxation within Collin County. The Collin County Central Appraisal process ensures resources are allocated effectively, supporting transparent property valuations and tax assessments. Understanding the Collin CAD budget allows property owners and stakeholders to track spending and assess its impact on appraisal services.

The budget funds staffing, professional services, technology upgrades, and appraisal review processes, ensuring accurate property valuations for tax purposes.

2025 Budget Insights: Key Changes and Trends

The 2025 Collin CAD budget reflects targeted increases in spending to enhance appraisal accuracy and operational efficiency.

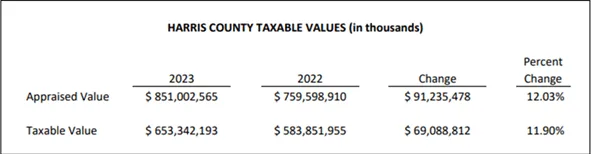

Collin County Property Values Overview

Collin County Appraisal experienced significant increases in appraised and taxable property values from 2022 to 2025, boosting tax revenue. This revenue is added to the CCAD budget, supporting improved services and appraisal processes.

Bid Farewell To High Property Taxes

Don’t overpay on your property taxes! Sign up now to get expert assistance with your Collin County property tax protest. Our team will handle your case with precision and maximize your property tax savings.

Take control of your property taxes today! Sign up now and start saving!