Budget for Appraisal District Hidalgo County

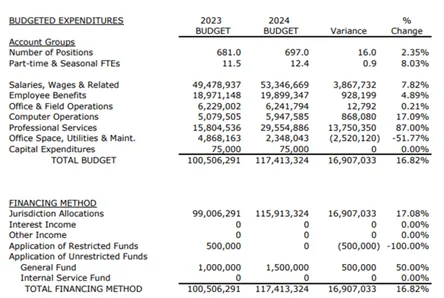

General Operations and Administrative Costs in Hidalgo CAD Budget

The Hidalgo County Appraisal District’s budget includes operational expenses necessary for maintaining accurate property valuations and supporting taxpayers. These costs cover staffing, office supplies, and IT infrastructure.

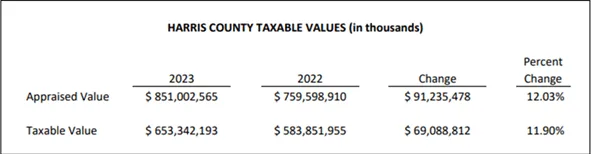

Property Valuation and Assessment Services in Hidalgo County Appraisal District

A significant portion of the budget is allocated to ensuring fair and accurate property valuations, which impact local tax revenues.

Public Transparency and Taxpayer Services

The district prioritizes taxpayer education and compliance with truth-in-taxation laws to maintain transparency.