Bexar County Property Tax Protest

Why Choose Tax Cutter?

Tax Cutter helps property owners by providing the best property tax protest services that ensure the best savings. Meanwhile, you just sit back and relax.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Bexar County Tax Appraisal

Your Bexar tax appraisal isn’t always as accurate as you may think. The appraisal districts value your home annually to assess property taxes, which can be inflated at times. Our Bexar County property tax protest has helped our clients save an average of $24,134 on their property valuation.

The Best Bexar County Property Tax Protest Company

Bexar County BCAD property taxes got you feeling stressed? Don’t just accept it! Protest property taxes! Check your assessment – if it seems unfair, you have the right to protest! Let Tax Cutter handle the hassle. We’ll be your property tax protest service battling for your fair share and potential savings. Stop overpaying, and start living easier. Get your free quote today.

How Tax Cutter Works?

Our objective is to make the property tax protest process as easy and user-friendly as possible.

Benefits of Choosing Bexar County Tax Protest Service

We are dedicated to delivering superior tax protest services tailored for Bexar County.

Don’t Overpay Taxes!

Thousands have saved hard-earned cash with our tax protest Bexar County BCAD. We fight unfair property appraisals to ensure you pay what’s truly owed, not a penny more. Let our experts handle the tax protest hassle and maximize your savings. Trust us, your savings await!

Accurate Valuations!

Worried your home or business is overvalued? Tax Cutter helps residential and commercial owners like you find the fair, accurate valuation your property deserves with a Bexar County BCAD property tax appeal. Our smooth process takes care of everything, maximizing your property tax savings. Enjoy the peace of mind of knowing you’re paying what’s due – no more, no less.

Expert Property Analysis

Don’t get overcharged on your Texas property taxes! Tax Cutter helps you find the fair, accurate valuation your property deserves with a Bexar County appraisal protest. We do the legwork, so you can relax. Forget tax code and confusing appraisals – our experts handle everything.

No Extra Payments

Relax! Tax Cutter doesn’t ask for a dime until you score savings on your tax bill. That’s right, no sign-up costs, no hidden fees – only pay when you win your Bexar County tax appraisal protest. Trust us to fight for your fair share, knowing you have nothing to lose and everything to gain. Let Tax Cutter take the risk, you reap the rewards!

Experienced Suggestions

Our tax protest experts know how to find legal loopholes and uncover inaccuracies that could be dragging down your home’s worth. The result? More money in your pocket and a more valuable property. Win-win! Don’t settle for an unfair tax burden – let Tax Cutter work its magic and keep more of your hard-earned cash.

Experts At Your Disposal

Your property tax protest is in good hands. At Tax Cutter, we’re dedicated to making the process simple and stress-free for you. From start to finish, you’ll experience exceptional customer service from our team of property tax experts. We’ll handle everything so you can focus on what matters most. Leave the hassle and worry to us – we’ll take care of the rest.

Your Guide to All Things Bexar CAD: Navigate with Ease

Reduce Your Property Tax With A Property Tax Appeal Bexar County

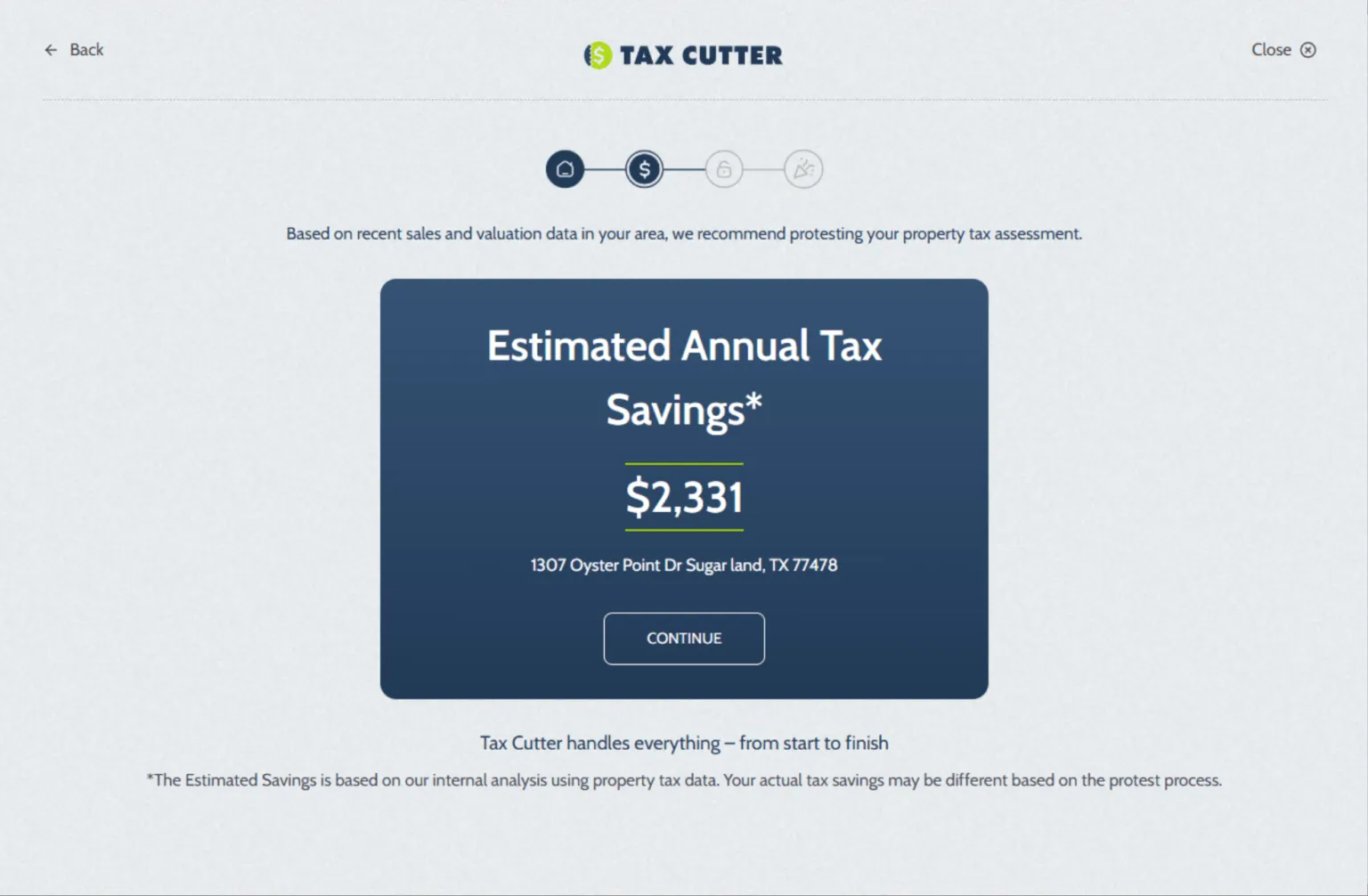

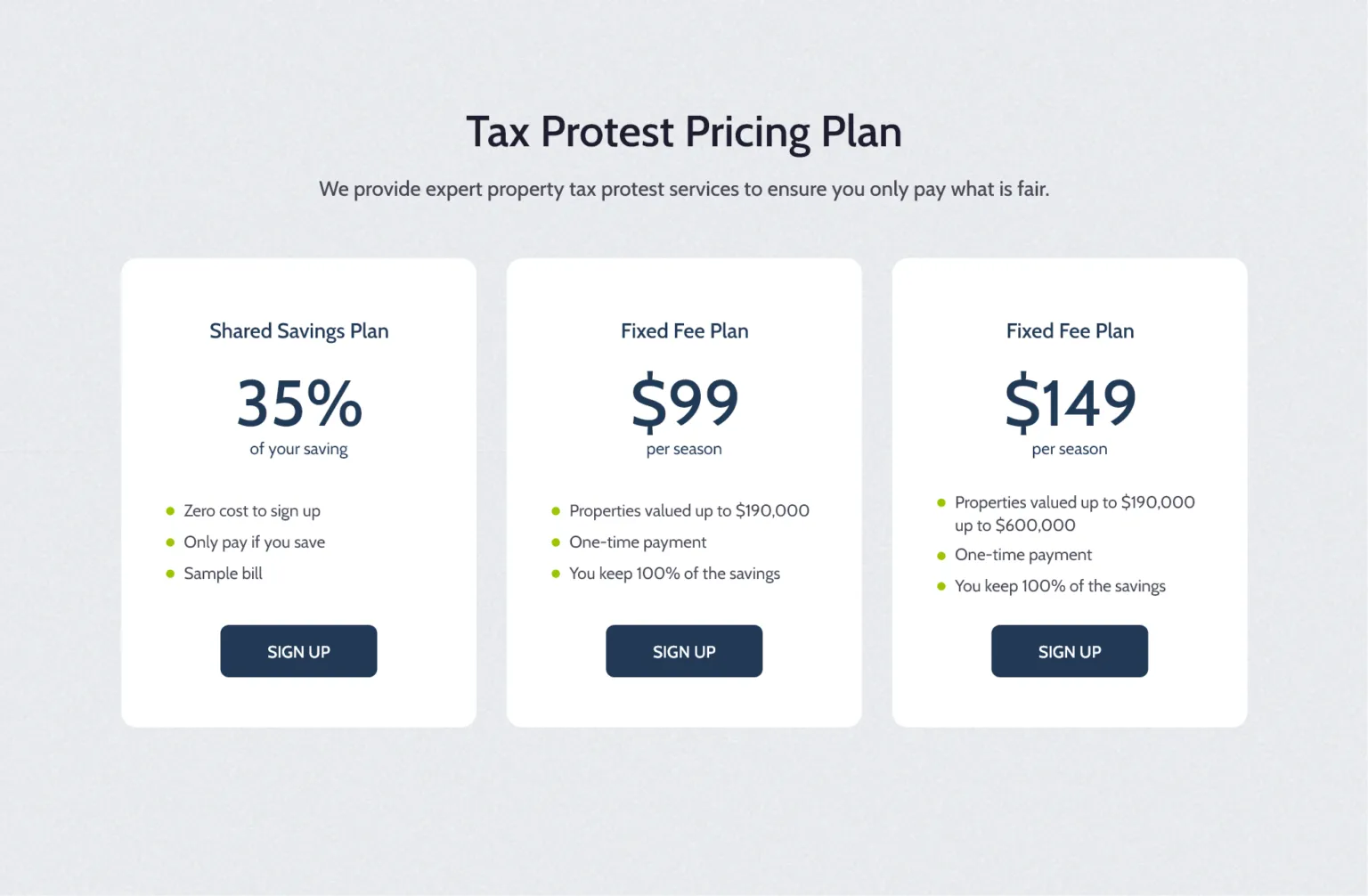

Don’t overpay! Reduce taxes with a property tax appeal! Many homeowners pay more than they should. Tax Cutter can help you fight unfair assessments with a Bexar County tax appraisal protest. We offer a free assessment review to identify potential errors, handle the stress-free protest process, and maximize your savings potential. Our Bexar County Texas tax protest service starts at just $99, or you can also pay 35% of the money we save you, we only get paid if we win your case. Get a free assessment review today and see how much you could save!