Budget for Brazoria Appraisal District

Budget for Brazoria Appraisal District

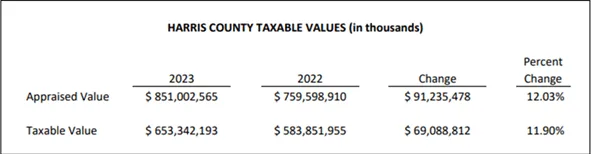

The Brazoria Appraisal District has a 2023 budget of $7,170,810, prioritizing efficiency and fiscal responsibility. With $3,803,570 allocated to salaries, the focus is on workforce retention and operational improvements. Funded primarily by taxing entities contributing $7,040,810, along with interest earnings and miscellaneous income, BCAD ensures accurate property valuations and supports Brazoria County CAD Property Search. Investments in technology enhance appraisal efficiency, aiding property owners in exemption monitoring services and tax protests for potential reductions.

2023 Budget Allocation of Brazoria Appraisal District – Key Updates & Financial Trends

The BCAD Brazoria County budget for 2023 reflects a strategic shift in spending priorities, focusing on service enhancement, infrastructure development, and cost efficiency. Key updates include:

This allocation underscores the Brazoria County Appraisal District‘s dedication to maintaining a transparent, effective, and financially stable appraisal system. Additionally, property owners benefit from commercial property tax protest assistance and better access to property tax reduction solutions.

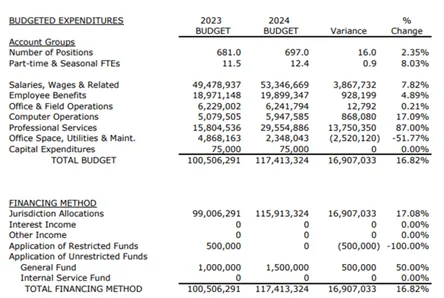

Budget Comparisons Overview – Financial Efficiency & Growth

The Brazoria Appraisal District budget for 2023 demonstrates cost efficiency when compared to similar districts. A detailed analysis reveals key financial trends:

These trends indicate that Brazoria County CAD is optimizing expenditures while maintaining high-quality appraisal services. By leveraging advanced exemption monitoring services, property owners can ensure they receive eligible property tax reductions. Additionally, those engaging in a Brazoria County property tax protest or a commercial property tax protest can benefit from a more efficient and transparent valuation process.

Bid Farewell To High Property Taxes

Tax Cutter helps you save more with professional property tax analysts who expertly protest on your behalf to the BCAD Brazoria County. Streamline the Texas property tax protest process by signing up today, and we’ll manage everything for you.