Cameron County CAD Budget Overview

Cameron County CAD Budget Overview

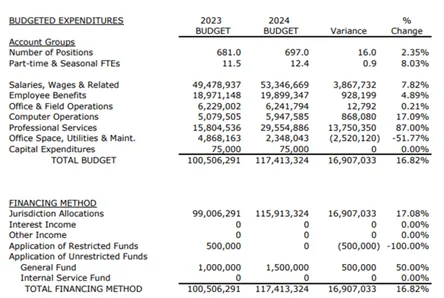

The 2024-2025 Cameron CAD budget focuses on economic growth, infrastructure, and public safety, with key investments in major projects like SpaceX and Rio Grande LNG. It includes tax relief, increased funding for roads and public safety, and enhanced employee benefits. The budget also reduces reliance on property taxes by utilizing toll bridge revenues.

Cameron County 2024-2025 Budget: Key Updates & Financial Trends.

Cameron County’s fiscal strategy for the 2024-2025 period reflects a strong focus on economic growth, infrastructure, and public safety, alongside responsible budget management.

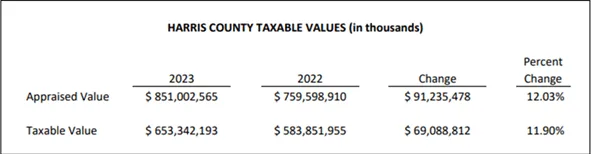

Cameron County CADProperty Values: Trends & Taxable Growth

Cameron County’s property values and taxable growth have shown a steady upward trend, fueled by economic investments, infrastructure projects, and increased commercial activity.

Bid Farewell To High Property Taxes

Tax Cutter helps you save more with professional property tax analysts who expertly protest on your behalf to the Cameron CAD Cameron County. Streamline the Texas tax protest process by signing up today, and we’ll manage everything for you.