Budget for Dallas CAD TX

2024 Budget Insights: Key Changes and Trends

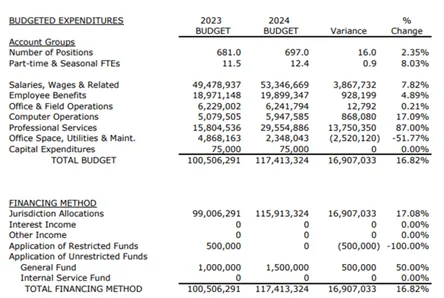

The Dallas Cad Tx budget is crucial for maintaining efficient property tax assessments and services in the county. Understanding the Dallas CAD budget allows residents and property owners to stay informed about how their tax dollars are being spent.

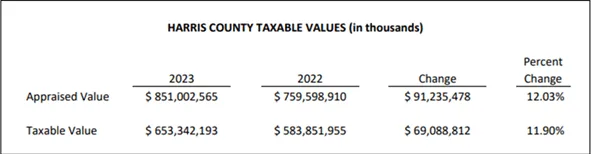

Dallas County Property Values Overview

Dallas County saw substantial growth in appraised and taxable property values from 2022 to 2024, leading to higher tax revenue. This additional revenue contributes to the Dallas CAD budget, enhancing services and appraisal processes.

Bid Farewell to High Property Taxes

Tax Cutter helps you save more with expert property tax analysts who vigorously protest on your behalf to the Dallas County Appraisal District. Simplify the Texas tax protest process by signing up today and let us take care of everything.