Budget for El Paso County Appraisal District

Budget for El Paso County Appraisal District

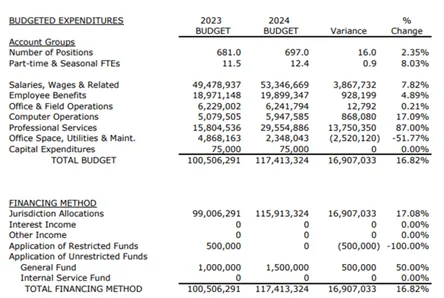

The EPCAD budget is essential for ensuring accurate property assessments and efficient tax collection, benefiting property owners and local governance. The 2023/2024 budget reflects increased funding for salaries, operating expenses, and professional services to keep up with rising property valuations and administrative requirements. EPCAD is funded entirely by the participating taxing entities within the county, ensuring proper resource allocation for real estate assessment.

2024 Budget Insights: Key Changes and Trends

The 2024 EPCAD budget saw significant shifts in allocations, with notable increases in some areas and decreases in others.

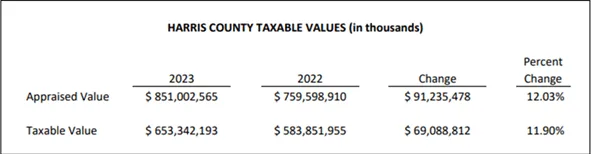

El Paso County Property Values and Revenue Growth

El Paso County’s real estate market has experienced steady growth, driving higher tax revenues and impacting budget allocations. Rising property values contribute to increased funding for essential county services.

Bid Farewell To High Property Taxes

Tax Cutter helps maximize your savings with professional property tax analysts who aggressively protest on your behalf to El Paso County appraisal district. Sign up today for expert support with Texas tax protest, and let us handle the process.