Understanding Harris County Property Tax and Commercial Market Growth

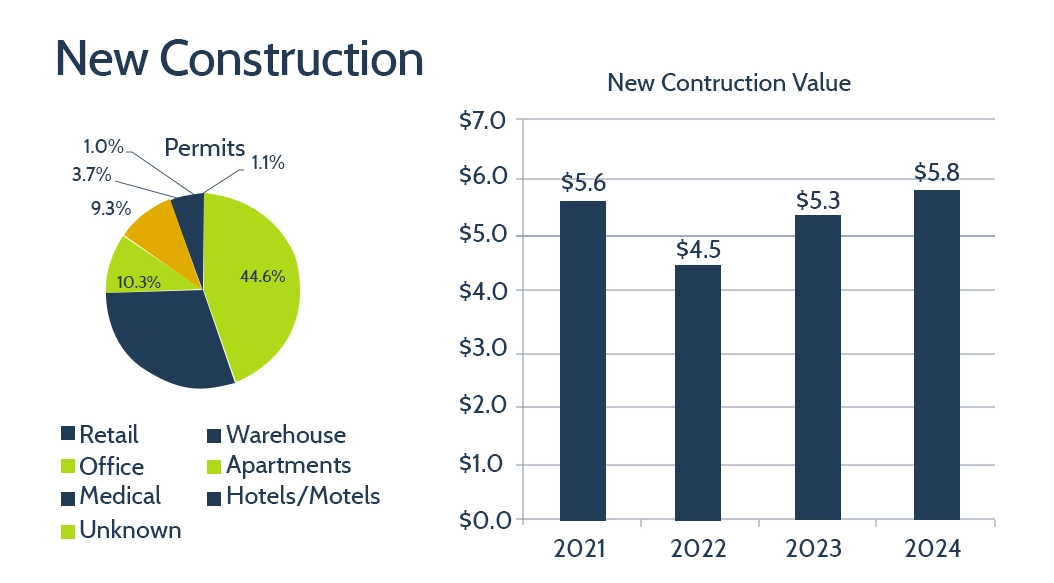

Trends in New Construction Permits and Value in Harris County

New construction trends indicate a strong demand for multi-family housing and a growing commercial construction market, according to the HCAD appraisal district.

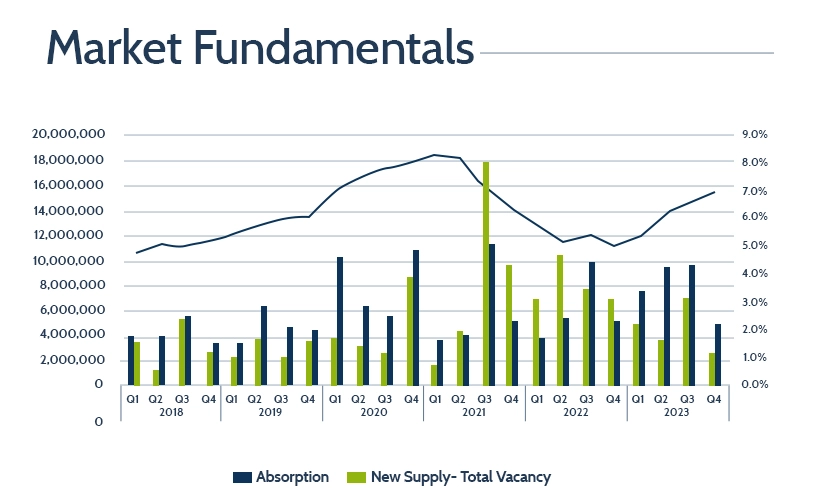

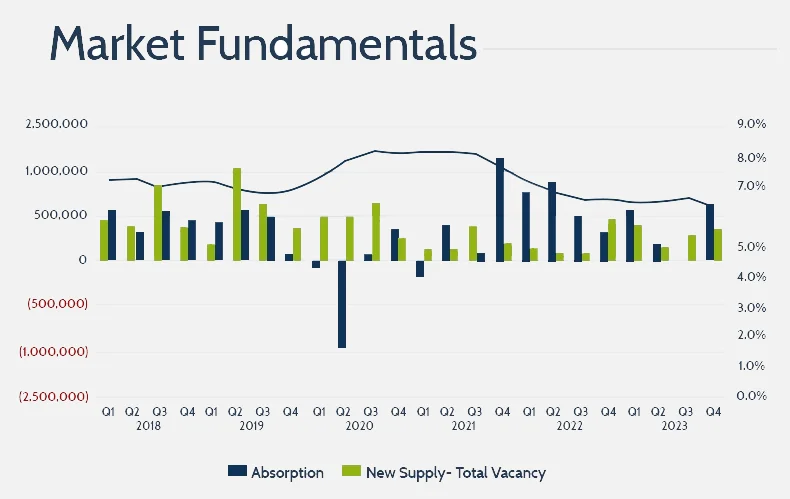

Adjustments in the Harris County Office Market

The office market continues to adapt to the ongoing changes brought on by the pandemic. Key metrics from the past year highlight shifts in new construction, space absorption, and vacancy rates.

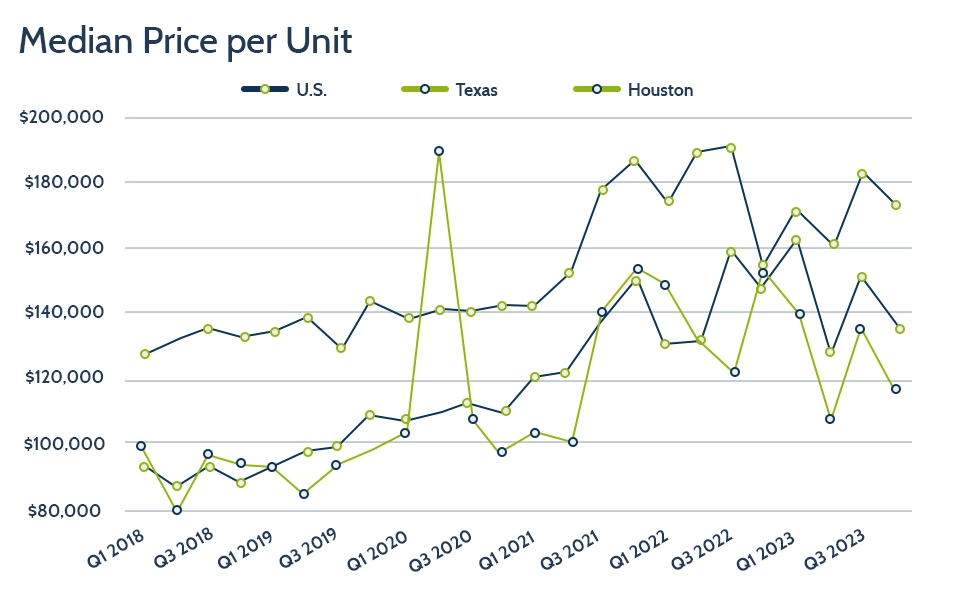

Harris County Apartment Market Overview

The apartment market ended 2023 with positive absorption, reflecting growth in new construction and a solid demand for units. Key metrics from the Harris County Appraisal District show a mixed trend in rental rates and occupancy.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.

Houston Texas Retail Sector

Despite market uncertainty, the Houston retail sector has shown resilience, with steady absorption and stable rental rates. Key metrics from the Houston appraisal district highlight a decrease in new construction and absorption.

Harris County Warehouse

The warehouse sector showed signs of slowdown in 2023, with a decrease in under-construction space and absorption, according to Harris County. However, quoted rates saw a significant increase.