Budget for Jefferson County Appraisal District Beaumont TX

Budget for Jefferson County Appraisal District

The Jefferson County Appraisal District Beaumont Tx budget plays a crucial role in maintaining efficient property tax assessments and services across the county. Therefore, understanding how tax dollars are allocated not only helps residents and property owners stay informed but also provides insight into JCAD’s financial priorities and operations.

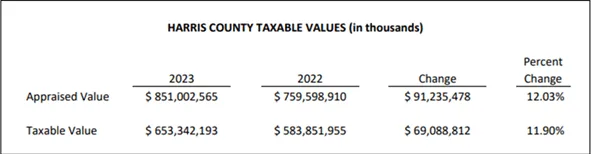

2023 Budget Allocation of Jefferson County Appraisal District – Key Updates & Financial Trends

The JCAD budget clearly reflects a commitment to efficient financial management, ensuring that funds are properly allocated for essential services, workforce compensation, and operational improvements. Moreover, the 2023 adopted budget demonstrates fiscal stability, as it features no revenue deficit.

Bid Farewell To High Property Taxes

Tax Cutter helps you fight excessive Jefferson County property taxes by protesting your appraised values before the Jefferson County Appraisal District.

Let us handle the entire process and secure the maximum property tax reduction for your property.