Smith County Property Tax Protest

Why Choose Tax Cutter?

Tax Cutter helps property owners by providing the best property tax protest services that ensure the best savings. Meanwhile, you just sit back and relax.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Property Taxes?

Smith County Property Tax Protest weighing you down? Don’t let an inflated property tax bill drain your budget! Your property tax depends on your home’s assessed value but what if that value is too high? At Tax Cutter, we’ve helped clients across Texas save thousands by challenging unfair property appraisals. The Smith County Appraisal District doesn’t always get it right, and overvalued homes can cost you more than they should. Our experts know Smith County CAD inside out and spot appraisal errors that could be costing you thousands. Let us fight for a fair assessment and keep more money in your pocket. The deadline is approaching fast. Get your free consultation today and take the first step toward cutting your tax bill. We’re ready to help you keep more of what’s yours.

Chop Your Taxes and Boost Your Savings

Struggling with your rising Smith County Property Tax Protest bill? Overvalued assessments lead many homeowners to pay more than they should. If you think your property is unfairly appraised, you have the legal right to file a protest. That’s where we come in. At Tax Cutter, we help homeowners navigate the Texas property tax protest process from start to finish. We’ve saved our clients tens of thousands of dollars—and last year, our average reduction was $24,134. Imagine what that could do for your budget. We work directly with the Smith County Tax Appraisal District to challenge inflated valuations and secure fair outcomes. As one of the most trusted property tax protest companies in Texas, we’re here to get you results. Schedule your free consultation now and let’s challenge your appraisal together.

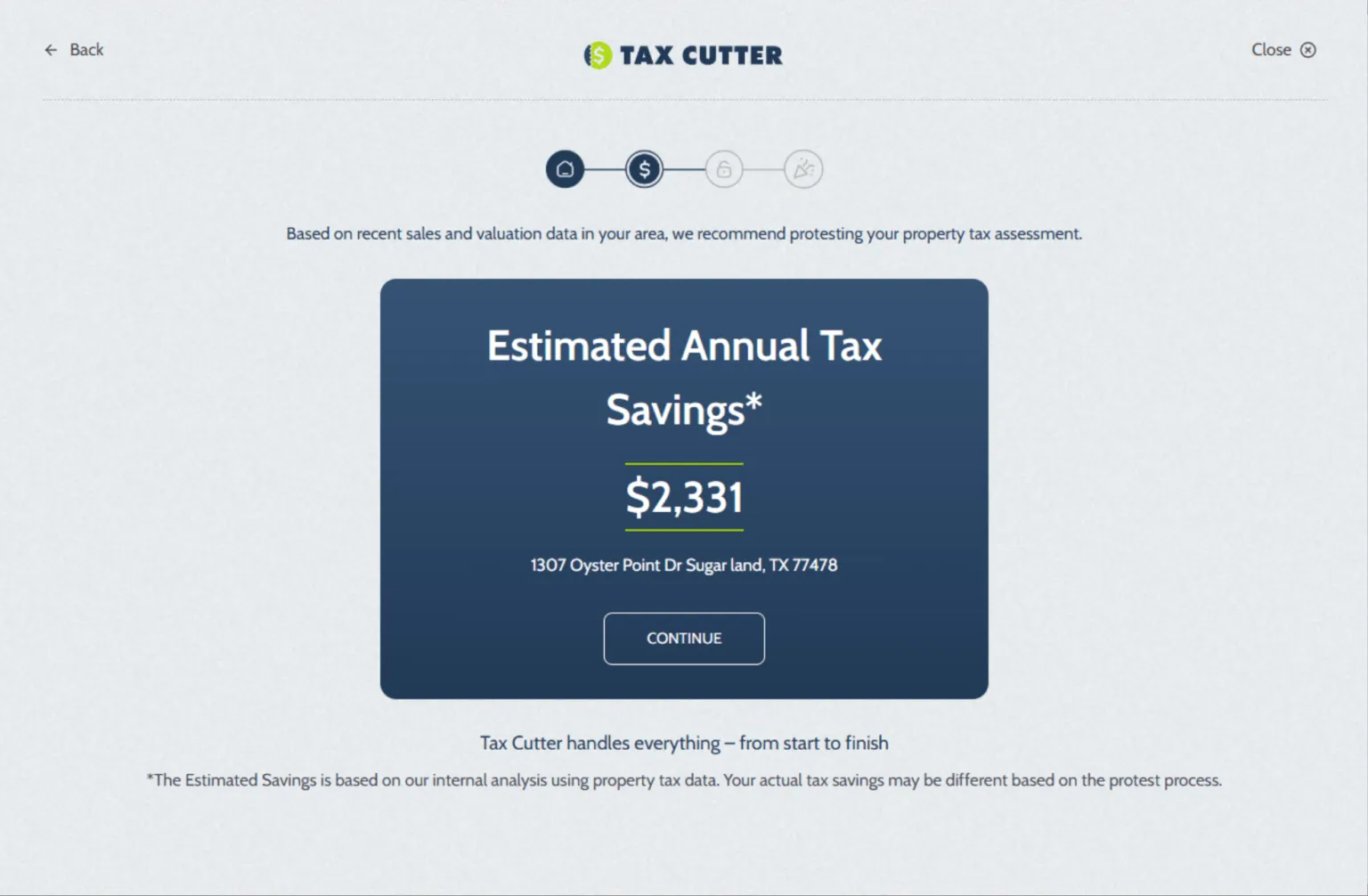

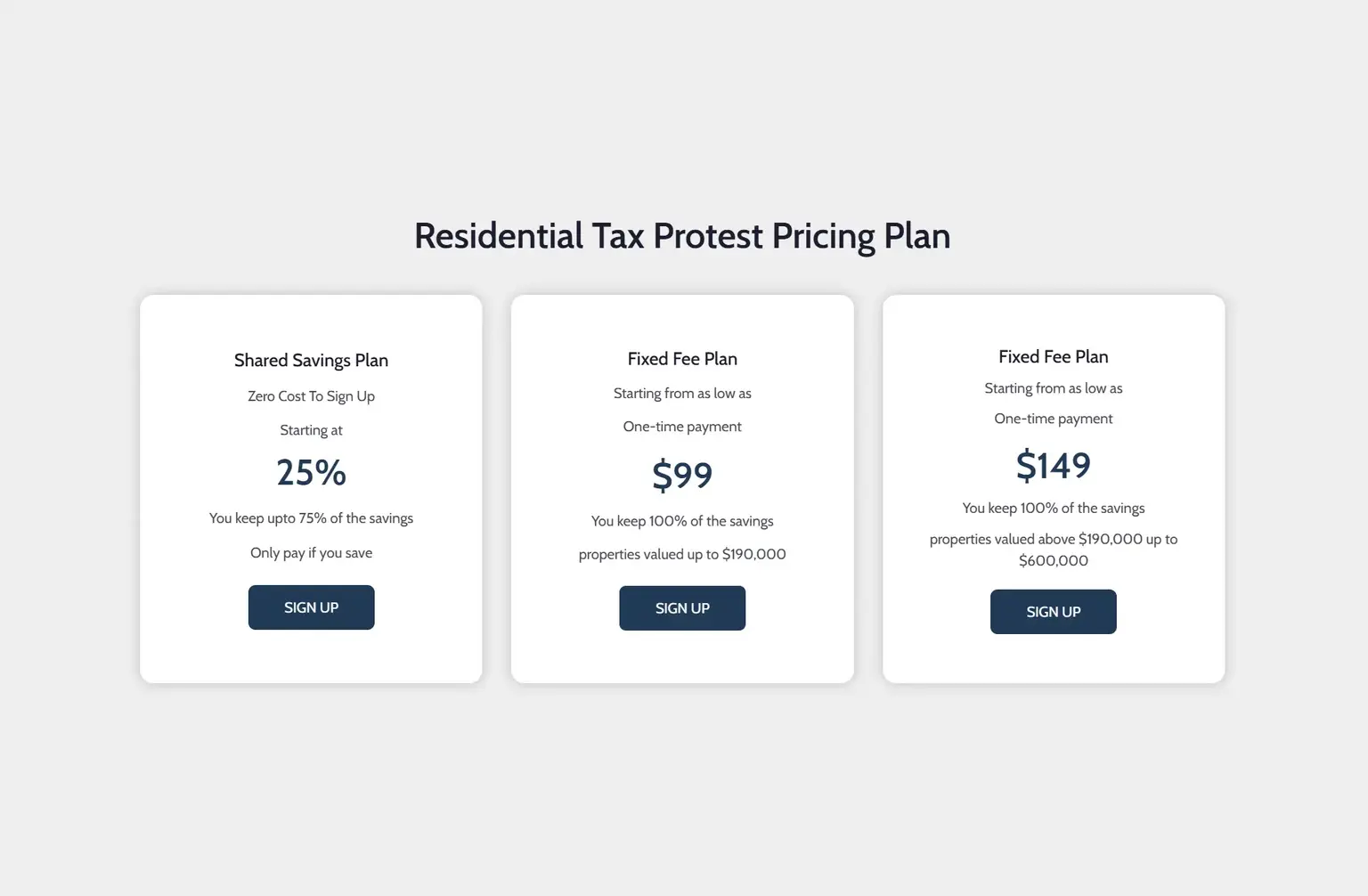

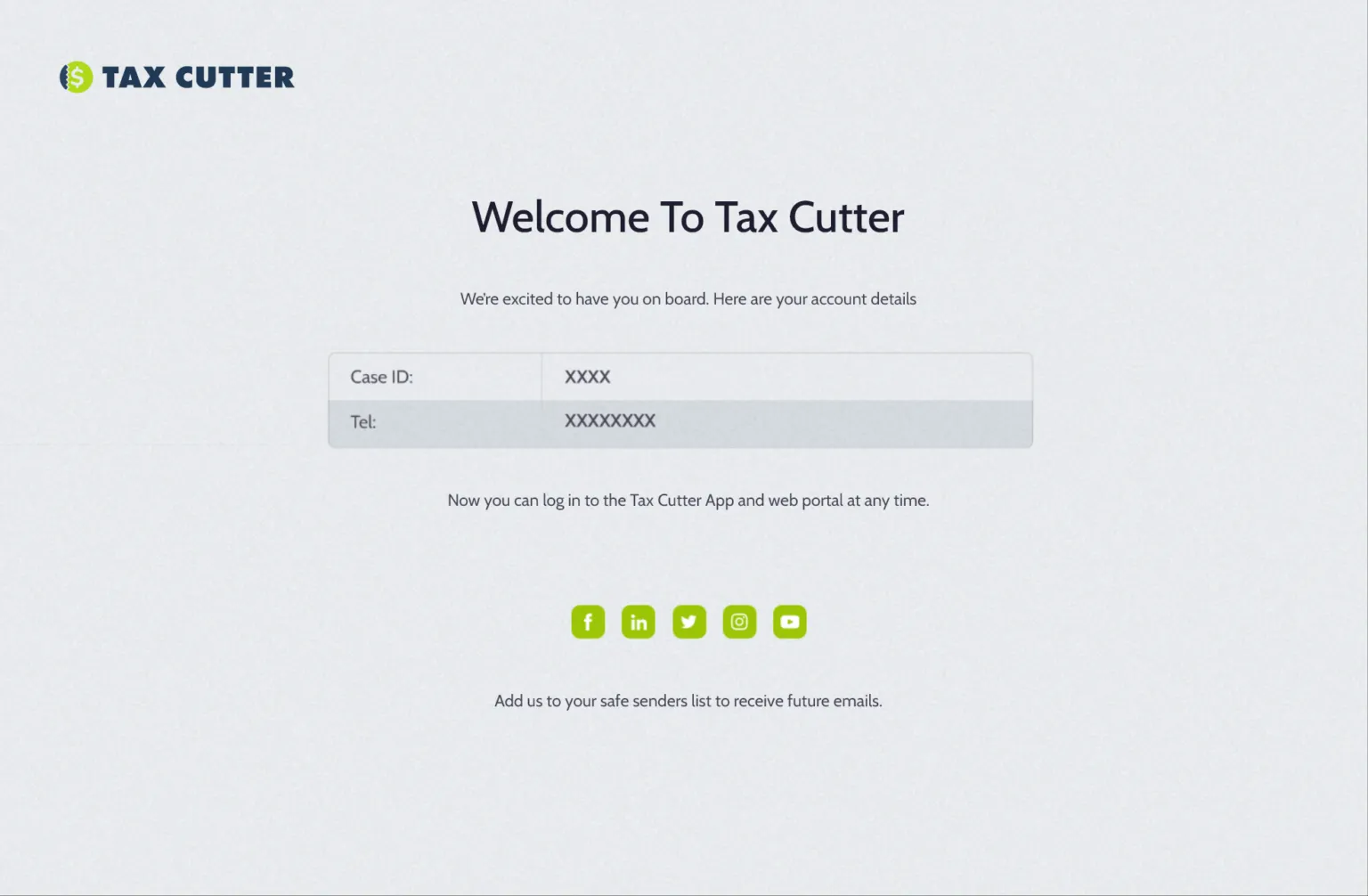

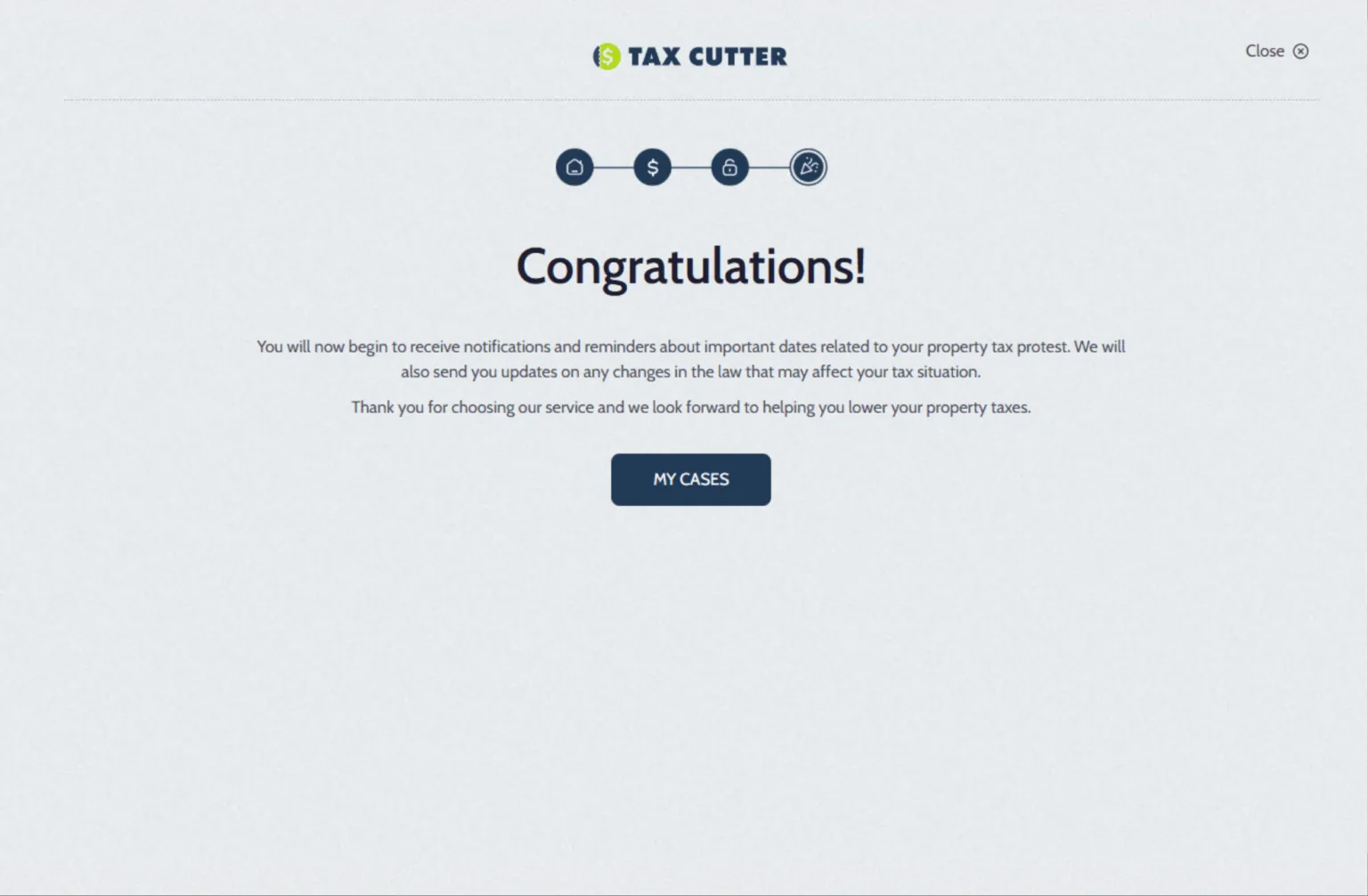

How Tax Cutter Works?

Our objective is to make the property tax protest process as easy and user-friendly as possible.

Stories of Trust, Savings, and Success

Benefits Of Choosing Smith County Tax Protest Services

We specialize in helping Smith County homeowners reduce their property tax burden through tailored, effective strategies designed to get real results.

Reduces Tax Burden

If your property’s value is overstated, a protest can lower your yearly taxes—keeping more money in your hands instead of going to the Appraisal District unnecessarily.

Provides Relief

A corrected appraisal means you finally pay your fair share. Our team works with Smith County CAD to ensure your home isn’t overvalued.

Make Your Property More Attractive

A lower tax burden makes your home more appealing to buyers and may enhance its overall market value.

Simplify the Protest Process

Working with a property tax consultant removes the guesswork. We manage the paperwork and handle every step—even direct communication with County.

Prevent Overpayment

Protesting your Smith County Property Tax Protest means taking control. Don’t let mistakes from the Smith Appraisal District lead to unnecessary costs.

Get Professional Help

The protest process can feel overwhelming. Our experienced consultants provide the guidance and expertise needed to secure the best possible outcome.

Your Guide to All Things: Navigate with Ease

Chop Your Bill With A Tax Protest. Don’t Overpay!

Many homeowners in Smith County pay more than they should due to mistakes in their property appraisal. You don’t have to be one of them. Filing a Texas property tax protest can help you recover thousands. At Tax Cutter, we’re experienced in working with the Smith County Appraisal District and helping property owners just like you. From preparing your case to submitting your protest, we’ll make the process easy and effective.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.