Budget for Tarrant county appraisal district

Budget for TAD Tarrant County

It is funded by the 72 taxing jurisdictions it serves, with funding allocations based on each jurisdiction’s proportionate share. The Tarrant Appraisal District (TAD) operates on a $29.43 million budget for FY 2024, up from $28.63 million in FY 2023. The majority (96.76% or $28.48M) comes from taxing unit allocations, with additional funding from interest earnings ($250K), data sales ($5.2K), 911 district payments ($197K), and penalty payments ($150K). A $350K transfer from unrestricted funds also contributes to the budget. This funding ensures accurate property appraisals, efficient operations, and compliance with Texas property tax laws.

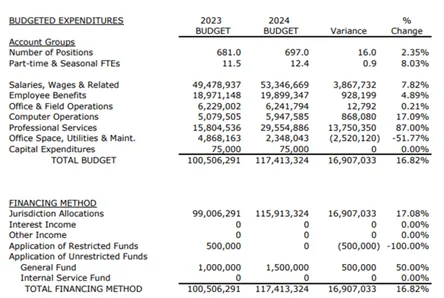

2024 Budget Insights: Key Changes and Trends

The TAD Tarrant County budget adjustments reflect evolving priorities in workforce expenses, property appraisals, and legal operations:

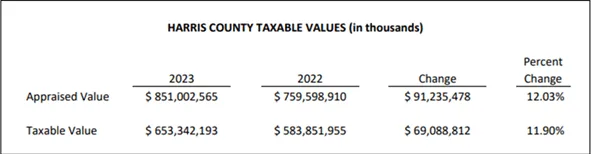

TAD Tarrant County Property Values Overview

In 2023,property values saw significant growth, reflecting the region’s strong economic momentum. This highlights the dynamic property market and TAD’s pivotal role in managing fair and accurate property appraisals across the county.

Bid Farewell to High Property Taxes

Tax Cutter helps you save more with professional property tax analysts who expertly protest on your behalf to the TAD Tarrant County. Streamline the Texas tax protest process by signing up today, and we’ll manage everything for you.