Budget for TCAD Travis County

Budget Insights of Travis County

The TCAD Travis County operates on a budget funded by 127 local taxing units, ensuring accurate property appraisals, efficient operations, and compliance with state property tax laws. For FY 2023, the TCAD Board of Directors approved a budget of $25,683,866. The allocation of funds by taxing unit type is highlighted in the chart, with school districts accounting for 49.44%, cities for 19.50%, and counties for 16.61%, among others.

2023 Budget Insights: Key Changes and Trends

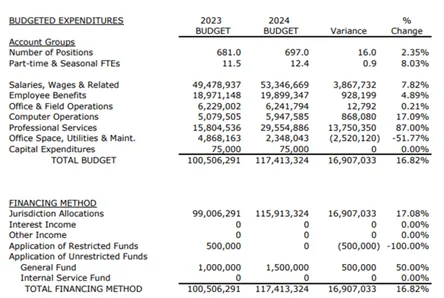

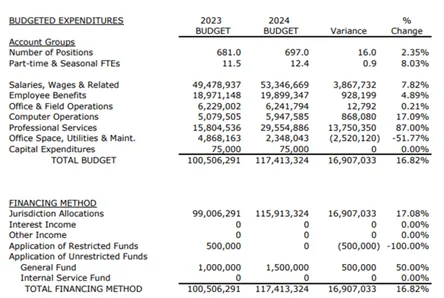

The budget table for Travis County highlights adjustments in expenditures and revenue allocations, reflecting evolving priorities in workforce, services, and infrastructure. Notable trends include:

TCAD Travis County Property Values Overview

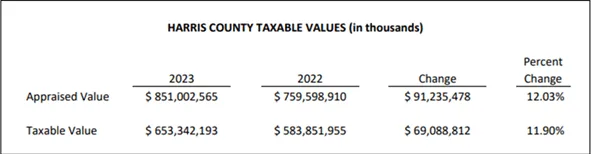

In 2022, TCAD Travis County saw record growth in property values, with single-family residences leading at $245.37 billion, followed by commercial real estate at $140.61 billion. This growth reflects the region’s strong economic momentum and rising property values.

Bid Farewell To High Property Taxes

Tax Cutter helps you save more with professional property tax analysts who expertly protest on your behalf to the TCAD Travis County. Streamline the property tax protest process by signing up today, and we’ll manage everything for you.